Instructions For Form Nyc - 2006

ADVERTISEMENT

Form NYC - 6.1B - 2006 - Instructions

Page 2

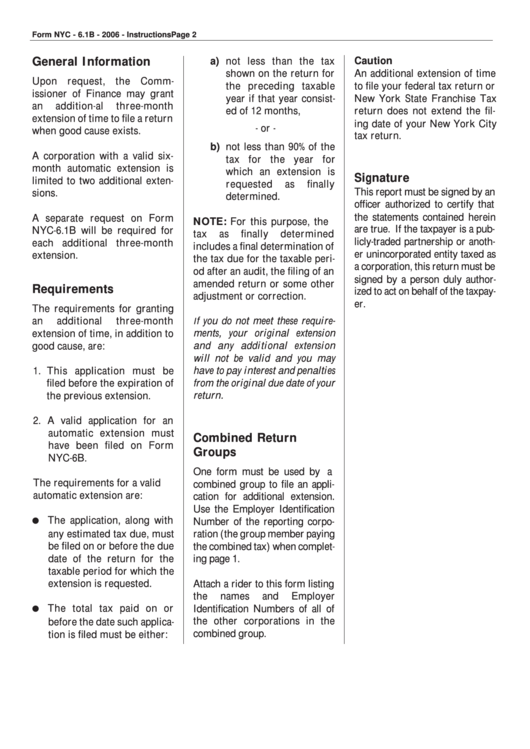

General Information

a) not less than the tax

Caution

shown on the return for

An additional extension of time

Upon request, the Comm-

the preceding taxable

to file your federal tax return or

issioner of Finance may grant

year if that year consist-

New York State Franchise Tax

an

addition-al

three-month

ed of 12 months,

return does not extend the fil-

extension of time to file a return

ing date of your New York City

- or -

when good cause exists.

tax return.

b) not less than 90% of the

A corporation with a valid six-

tax for the year for

month automatic extension is

which an extension is

Signature

limited to two additional exten-

requested

as

finally

This report must be signed by an

sions.

determined.

officer authorized to certify that

the statements contained herein

A separate request on Form

NOTE: For this purpose, the

are true. If the taxpayer is a pub-

NYC-6.1B will be required for

tax

as

finally

determined

licly-traded partnership or anoth-

each additional three-month

includes a final determination of

er unincorporated entity taxed as

extension.

the tax due for the taxable peri-

a corporation, this return must be

od after an audit, the filing of an

signed by a person duly author-

amended return or some other

Requirements

ized to act on behalf of the taxpay-

adjustment or correction.

er.

The requirements for granting

an

additional

three-month

f you do not meet these require-

I

extension of time, in addition to

ments, your original extension

good cause, are:

and any additional extension

will not be valid and you may

1. This application must be

have to pay interest and penalties

filed before the expiration of

from the original due date of your

the previous extension.

return.

2. A valid application for an

automatic extension must

Combined Return

have been filed on Form

Groups

NYC-6B.

One form must be used by a

The requirements for a valid

combined group to file an appli-

automatic extension are:

cation for additional extension.

Use the Employer Identification

The application, along with

Number of the reporting corpo-

any estimated tax due, must

ration (the group member paying

be filed on or before the due

the combined tax) when complet-

date of the return for the

ing page 1.

taxable period for which the

extension is requested.

Attach a rider to this form listing

the

names

and

Employer

The total tax paid on or

Identification Numbers of all of

the other corporations in the

before the date such applica-

combined group.

tion is filed must be either:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1