Form 500-Ec - Modified Net Income Tax Return For Electric Cooperatives 2006

ADVERTISEMENT

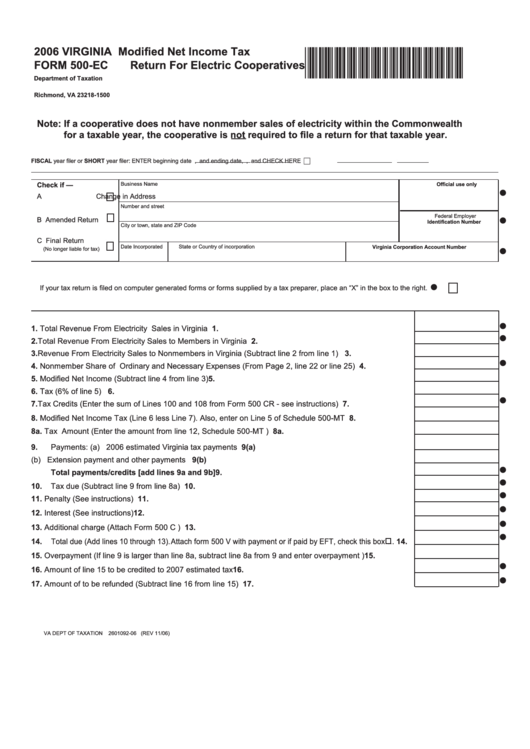

2006 VIRGINIA

Modified Net Income Tax

*VAECOP106888*

FORM 500-EC

Return For Electric Cooperatives

Department of Taxation

P.O. Box 1500

Richmond, VA 23218-1500

Note: If a cooperative does not have nonmember sales of electricity within the Commonwealth

for a taxable year, the cooperative is not required to file a return for that taxable year.

FISCAL year filer or SHORT year filer: ENTER beginning date

,

and ending date,

,

and CHECK HERE j

Check if —

Business Name

Official use only

w

A Change in Address

Number and street

Federal Employer

w

B Amended Return

Identification Number

City or town, state and ZIP Code

C Final Return

Date Incorporated

State or Country of incorporation

Virginia Corporation Account Number

(No longer liable for tax)

w

w

If your tax return is filed on computer generated forms or forms supplied by a tax preparer, place an “X” in the box to the right.

w

1.

Total Revenue From Electricity Sales in Virginia .............. ...................................................................... 1.

w

2.

Total Revenue From Electricity Sales to Members in Virginia .................................................................. 2.

3.

Revenue From Electricity Sales to Nonmembers in Virginia (Subtract line 2 from line 1) ....................... 3.

w

4.

Nonmember Share of Ordinary and Necessary Expenses (From Page 2, line 22 or line 25) ................. 4.

5.

Modified Net Income (Subtract line 4 from line 3) .................................................................................... 5.

6.

Tax (6% of line 5) ..................................................................................................................................... 6.

w

7.

Tax Credits (Enter the sum of Lines 100 and 108 from Form 500 CR - see instructions) ........................ 7.

8.

Modified Net Income Tax (Line 6 less Line 7). Also, enter on Line 5 of Schedule 500-MT ...................... 8.

8a. Tax Amount (Enter the amount from line 12, Schedule 500-MT ) ...........................................................8a.

9. Payments: (a) 2006 estimated Virginia tax payments ........................................................................9(a)

(b) Extension payment and other payments ....................................................................9(b)

w

Total payments/credits [add lines 9a and 9b] ....................................................................................9.

w

10. Tax due (Subtract line 9 from line 8a) ......................................................................................................10.

w

11. Penalty (See instructions) ......................................................................................................................11.

w

12.

Interest (See instructions)........................................................................................................................12.

w

13. Additional charge (Attach Form 500 C ) .................................................................................................. 13.

w

14. Total due (Add lines 10 through 13). Attach form 500 V with payment or if paid by EFT, check this box

... 14.

15. Overpayment (If line 9 is larger than line 8a, subtract line 8a from 9 and enter overpayment ) .............. 15.

w

16. Amount of line 15 to be credited to 2007 estimated tax .......................................................................... 16.

w

17. Amount of to be refunded (Subtract line 16 from line 15) ....................................................................... 17.

VA DEPT OF TAXATION

2601092-06 (REV 11/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4