Form Ct-V - Fed/state Payment Voucher - 2010

ADVERTISEMENT

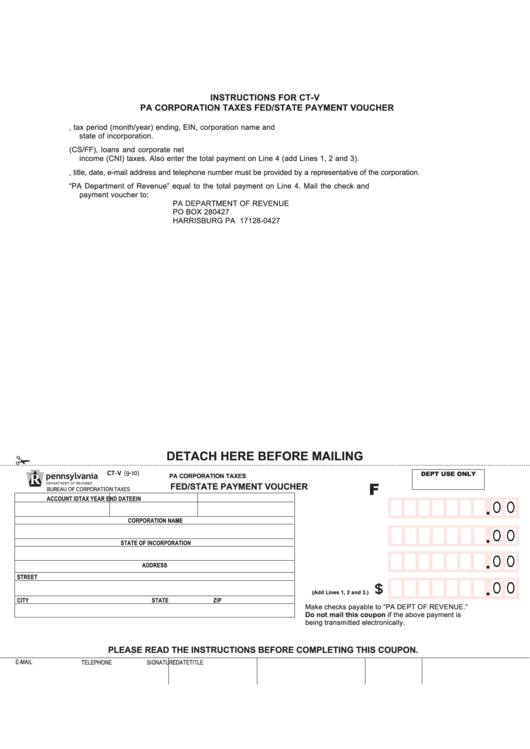

INSTRUCTIONS FOR CT-V

PA CORPORATION TAXES FED/STATE PAYMENT VOUCHER

1. Enter your account information including Account ID, tax period (month/year) ending, EIN, corporation name and

state of incorporation.

2. Enter payments that are due and included for capital stock/foreign franchise (CS/FF), loans and corporate net

income (CNI) taxes. Also enter the total payment on Line 4 (add Lines 1, 2 and 3).

3. Signature, title, date, e-mail address and telephone number must be provided by a representative of the corporation.

4. Make check payable to “PA Department of Revenue” equal to the total payment on Line 4. Mail the check and

payment voucher to:

PA DEPARTMENT OF REVENUE

PO BOX 280427

HARRISBURG PA 17128-0427

✁

DETACH HERE BEFORE MAILING

CT-V (9-10)

DEPT USE ONLY

PA CORPORATION TAXES

F

FED/STATE PAYMENT VOUCHER

BUREAU OF CORPORATION TAXES

ACCOUNT ID

TAX YEAR END DATE

EIN

O O

1. CS/FF TAX PAYMENT

•

CORPORATION NAME

O O

2. LOANS TAX PAYMENT

•

STATE OF INCORPORATION

O O

3. CNI TAX PAYMENT

ADDRESS

•

STREET

O O

4. TOTAL PAYMENT

$

(Add Lines 1, 2 and 3.)

•

CITY

STATE

ZIP

Make checks payable to “PA DEPT OF REVENUE.”

Do not mail this coupon if the above payment is

being transmitted electronically.

PLEASE READ THE INSTRUCTIONS BEFORE COMPLETING THIS COUPON.

E-MAIL

TELEPHONE

SIGNATURE

DATE

TITLE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1