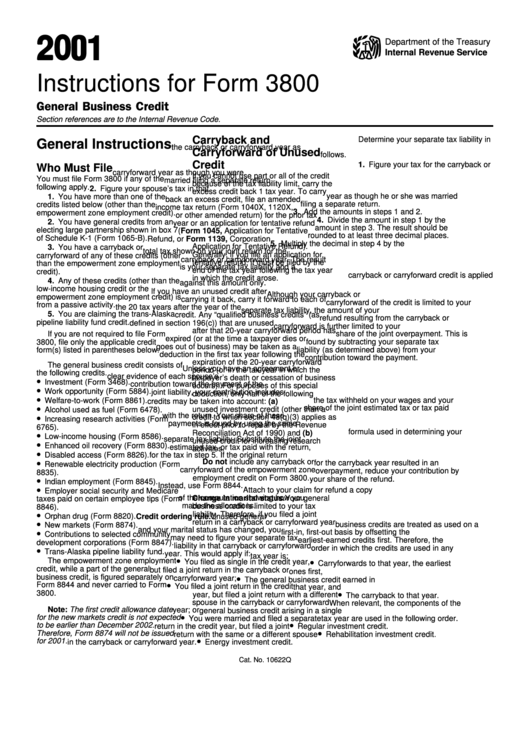

Instructions For Form 3800 - General Business Credit - Internal Revenue Service - 2001

ADVERTISEMENT

01

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 3800

General Business Credit

Section references are to the Internal Revenue Code.

Carryback and

Determine your separate tax liability in

General Instructions

the carryback or carryforward year as

Carryforward of Unused

follows.

Credit

1. Figure your tax for the carryback or

Who Must File

carryforward year as though you were

If you cannot use part or all of the credit

You must file Form 3800 if any of the

married filing a separate return.

because of the tax liability limit, carry the

following apply.

2. Figure your spouse’s tax in that

excess credit back 1 tax year. To carry

year as though he or she was married

1. You have more than one of the

back an excess credit, file an amended

filing a separate return.

credits listed below (other than the

income tax return (Form 1040X, 1120X,

3. Add the amounts in steps 1 and 2.

empowerment zone employment credit).

or other amended return) for the prior tax

4. Divide the amount in step 1 by the

2. You have general credits from an

year or an application for tentative refund

amount in step 3. The result should be

electing large partnership shown in box 7

(Form 1045, Application for Tentative

rounded to at least three decimal places.

of Schedule K-1 (Form 1065-B).

Refund, or Form 1139, Corporation

5. Multiply the decimal in step 4 by the

Application for Tentative Refund).

3. You have a carryback or

total tax shown on your joint return for the

Generally, if you file an application for

carryforward of any of these credits (other

carryback or carryforward year. The result

tentative refund, it must be filed by the

than the empowerment zone employment

is your separate tax liability and a

end of the tax year following the tax year

credit).

carryback or carryforward credit is applied

in which the credit arose.

4. Any of these credits (other than the

against this amount only.

low-income housing credit or the

If you have an unused credit after

Although your carryback or

empowerment zone employment credit) is

carrying it back, carry it forward to each of

carryforward of the credit is limited to your

from a passive activity.

the 20 tax years after the year of the

separate tax liability, the amount of your

5. You are claiming the trans-Alaska

credit. Any “qualified business credits” (as

refund resulting from the carryback or

pipeline liability fund credit.

defined in section 196(c)) that are unused

carryforward is further limited to your

after that 20-year carryforward period has

share of the joint overpayment. This is

If you are not required to file Form

expired (or at the time a taxpayer dies or

found by subtracting your separate tax

3800, file only the applicable credit

goes out of business) may be taken as a

liability (as determined above) from your

form(s) listed in parentheses below.

deduction in the first tax year following the

contribution toward the payment.

expiration of the 20-year carryforward

The general business credit consists of

Unless you have an agreement or

period (or in the tax year in which the

the following credits.

clear evidence of each spouse’s

taxpayer’s death or cessation of business

•

Investment (Form 3468).

contribution toward the payment of the

occurs). For purposes of this special

•

Work opportunity (Form 5884).

joint liability, your contribution includes

deduction, only half of the following

•

the tax withheld on your wages and your

Welfare-to-work (Form 8861).

credits may be taken into account: (a)

•

share of the joint estimated tax or tax paid

unused investment credit (other than a

Alcohol used as fuel (Form 6478).

•

with the return. Your share of these

credit to which section 48(q)(3) applies as

Increasing research activities (Form

payments is found by using the same

in effect prior to repeal by the Revenue

6765).

formula used in determining your

•

Reconciliation Act of 1990) and (b)

Low-income housing (Form 8586).

separate tax liability. Substitute the joint

unused credit for increasing research

•

Enhanced oil recovery (Form 8830).

estimated tax, or tax paid with the return,

activities.

•

Disabled access (Form 8826).

for the tax in step 5. If the original return

•

Do not include any carryback or

for the carryback year resulted in an

Renewable electricity production (Form

carryforward of the empowerment zone

overpayment, reduce your contribution by

8835).

•

employment credit on Form 3800.

your share of the refund.

Indian employment (Form 8845).

Instead, use Form 8844.

•

Attach to your claim for refund a copy

Employer social security and Medicare

of the computation showing how you

Change in marital status. Your general

taxes paid on certain employee tips (Form

made the allocations.

business credit is limited to your tax

8846).

•

liability. Therefore, if you filed a joint

Orphan drug (Form 8820).

Credit ordering rule. Unused general

•

return in a carryback or carryforward year

business credits are treated as used on a

New markets (Form 8874).

and your marital status has changed, you

•

first-in, first-out basis by offsetting the

Contributions to selected community

may need to figure your separate tax

earliest-earned credits first. Therefore, the

development corporations (Form 8847).

liability in that carryback or carryforward

•

order in which the credits are used in any

Trans-Alaska pipeline liability fund.

year. This would apply if:

tax year is:

•

•

The empowerment zone employment

You filed as single in the credit year,

Carryforwards to that year, the earliest

credit, while a part of the general

but filed a joint return in the carryback or

ones first,

•

business credit, is figured separately on

carryforward year;

The general business credit earned in

•

Form 8844 and never carried to Form

You filed a joint return in the credit

that year, and

•

3800.

year, but filed a joint return with a different

The carryback to that year.

spouse in the carryback or carryforward

When relevant, the components of the

Note: The first credit allowance date

year; or

general business credit arising in a single

•

for the new markets credit is not expected

You were married and filed a separate

tax year are used in the following order.

•

to be earlier than December 2002.

return in the credit year, but filed a joint

Regular investment credit.

•

Therefore, Form 8874 will not be issued

return with the same or a different spouse

Rehabilitation investment credit.

•

for 2001.

in the carryback or carryforward year.

Energy investment credit.

Cat. No. 10622Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2