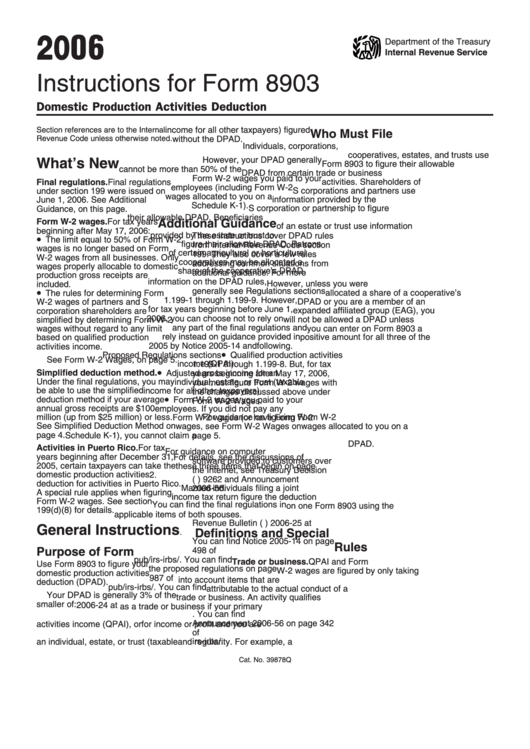

Instructions For Form 8903 - Domestic Production Activities Deduction - Internal Revenue Service - 2006

ADVERTISEMENT

2006

Department of the Treasury

Internal Revenue Service

Instructions for Form 8903

Domestic Production Activities Deduction

Section references are to the Internal

income for all other taxpayers) figured

Who Must File

Revenue Code unless otherwise noted.

without the DPAD.

Individuals, corporations,

cooperatives, estates, and trusts use

However, your DPAD generally

What’s New

Form 8903 to figure their allowable

cannot be more than 50% of the

DPAD from certain trade or business

Form W-2 wages you paid to your

Final regulations. Final regulations

activities. Shareholders of

employees (including Form W-2

under section 199 were issued on

S corporations and partners use

wages allocated to you on a

June 1, 2006. See Additional

information provided by the

Schedule K-1).

Guidance, on this page.

S corporation or partnership to figure

their allowable DPAD. Beneficiaries

Form W-2 wages. For tax years

Additional Guidance

of an estate or trust use information

beginning after May 17, 2006:

provided by the estate or trust to

•

These instructions cover DPAD rules

The limit equal to 50% of Form W-2

figure their allowable DPAD. Patrons

from Internal Revenue Code section

wages is no longer based on Form

of certain agricultural or horticultural

199. They also cover a few rules

W-2 wages from all businesses. Only

cooperatives may be allocated a

addressing common situations from

wages properly allocable to domestic

share of the cooperative’s DPAD.

additional guidance. For more

production gross receipts are

information on the DPAD rules,

included.

However, unless you were

•

generally see Regulations sections

The rules for determining Form

allocated a share of a cooperative’s

1.199-1 through 1.199-9. However,

W-2 wages of partners and S

DPAD or you are a member of an

for tax years beginning before June 1,

corporation shareholders are

expanded affiliated group (EAG), you

2006, you can choose not to rely on

simplified by determining Form W-2

will not be allowed a DPAD unless

any part of the final regulations and

wages without regard to any limit

you can enter on Form 8903 a

rely instead on guidance provided in

based on qualified production

positive amount for all three of the

2005 by Notice 2005-14 and

activities income.

following.

•

Proposed Regulations sections

Qualified production activities

See Form W-2 Wages, on page 5.

1.199-1 through 1.199-8. But, for tax

income (QPAI).

•

Simplified deduction method.

Adjusted gross income for an

years beginning after May 17, 2006,

Under the final regulations, you may

individual, estate, or trust (taxable

you must figure Form W-2 wages with

be able to use the simplified

income for all other taxpayers).

the changes discussed above under

•

deduction method if your average

Form W-2 wages you paid to your

Form W-2 Wages.

annual gross receipts are $100

employees. If you did not pay any

million (up from $25 million) or less.

For guidance on figuring Form W-2

Form W-2 wages (or have Form W-2

See Simplified Deduction Method on

wages, see Form W-2 Wages on

wages allocated to you on a

page 4.

page 5.

Schedule K-1), you cannot claim a

DPAD.

Activities in Puerto Rico. For tax

For guidance on computer

years beginning after December 31,

For details, see the discussions of

software provided to customers over

2005, certain taxpayers can take the

these three items that begin on page

the Internet, see Treasury Decision

domestic production activities

2.

(T.D.) 9262 and Announcement

deduction for activities in Puerto Rico.

Married individuals filing a joint

2006-56.

A special rule applies when figuring

income tax return figure the deduction

Form W-2 wages. See section

You can find the final regulations in

on one Form 8903 using the

199(d)(8) for details.

T.D. 9263 on page 1063 of Internal

applicable items of both spouses.

Revenue Bulletin (I.R.B.) 2006-25 at

General Instructions

Definitions and Special

You can find Notice 2005-14 on page

Rules

Purpose of Form

498 of I.R.B. 2005-7 at

pub/irs-irbs/irb05-07.pdf. You can find

Trade or business. QPAI and Form

Use Form 8903 to figure your

the proposed regulations on page

W-2 wages are figured by only taking

domestic production activities

987 of I.R.B. 2005-47 at

into account items that are

deduction (DPAD).

pub/irs-irbs/irb05-47.pdf. You can find

attributable to the actual conduct of a

Your DPAD is generally 3% of the

T.D. 9262 on page 1040 of I.R.B.

trade or business. An activity qualifies

smaller of:

2006-24 at pub/irs-irbs/

as a trade or business if your primary

irb06-24.pdf. You can find

1. Your qualified production

purpose for engaging in the activity is

Announcement 2006-56 on page 342

activities income (QPAI), or

for income or profit and you are

of I.R.B. 2006-35 at pub/

2. Your adjusted gross income for

involved in the activity with continuity

irs-irbs/irb06-35.pdf.

an individual, estate, or trust (taxable

and regularity. For example, a

Cat. No. 39878Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8