Instructions For Form 3115 - Application For Change In Accounting Method - Internal Revenue Service - 2006 Page 7

ADVERTISEMENT

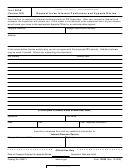

change its method of accounting to properly capitalize such

Accrued income . . . . . . . . . . . . . . . .

$250,000

costs. The computation of the section 481(a) adjustment with

Less:

respect to the change in method of accounting may be

Uncollectible amount . . . . . . . . . . . .

50,000

demonstrated as follows:

Net income accrued but not received . .

$200,000

Beginning inventory for year of change under

Less:

proposed method . . . . . . . . . . . . . . . . . . . . . . .

$120,000

Beginning inventory for year of change under

Accrued expenses . . . . . . . . . . . . . .

75,000

present method . . . . . . . . . . . . . . . . . . . . . . . .

100,000

Expenses deducted as recurring item

5,000

Difference (positive section 481(a) adjustment) . . . . .

+$ 20,000

Total expenses accrued but not paid . .

80,000

Section 481(a) adjustment . . . . . . . .

$120,000

Schedule A—Change in Overall Method

of Accounting

Line 2. If an applicant is requesting to use the recurring item

exception (section 461(h)(3)), the section 481(a) adjustment

Part I—Change in Overall Method

must include the amount of the additional deduction that results

from using the recurring item exception.

All applicants filing to change their overall method of accounting

must complete Part I, including applicants filing under

Part II—Change to the Cash Method For

designated automatic accounting method change numbers 30,

Advance Consent Request

32, 33, and 34 in the List of Automatic Accounting Method

Changes.

Limits on cash method use. Except as provided below, C

corporations and partnerships with a C corporation as a partner

Lines 1a through 1g. Enter the amounts requested on lines 1a

may not use the cash method of accounting. Tax shelters, also,

through 1g, even though the calculation of some amounts may

are precluded from using the cash method. For this purpose, a

not have been required in determining taxable income due to

trust subject to tax on unrelated business income under section

the applicant’s present method of accounting.

511(b) is treated as a C corporation with respect to its unrelated

trade or business activities.

Note: Do not include amounts that are not attributable to the

change in method of accounting, such as amounts that correct

The limit on the use of the cash method under section 448

a math or posting error or errors in calculating tax liability.

does not apply to:

1. Farming businesses as defined in section 448(d)(1).

Line 1b. Enter amounts received or reported as income in a

2. Qualified personal service corporations as defined in

prior year that were not earned as of the beginning of the year

section 448(d)(2).

of change. Examples include:

3. C corporations and partnerships with a C corporation as

1. An advance payment received in a prior year for goods

a partner if the corporation or partnership has gross receipts of

that were not delivered by the beginning of the year of change

$5 million or less. See section 448(b)(3) and (c) to determine if

may be reported upon delivery if the taxpayer qualifies under

the applicant qualifies for this exception.

Regulations section 1.451-5. If any amounts entered on line 1b

are for advance payments, complete Schedule B. See the

For farming corporations and partnerships with a C

instructions for Schedule B before completing Schedule B.

corporation as a partner, see section 447 for limits on the use of

2. A discount on installment loans is reported as income in

the cash method.

the year the loans were made instead of in the year(s) the

income was received or earned.

Use of the cash method is also limited under Regulations

sections 1.471-1 and 1.446-1(c)(2)(i) if the applicant purchases,

produces, or sells merchandise that is an income-producing

Line 1h. Enter the net amount, which is the net section 481(a)

factor in its business. However, for exceptions to this limitation,

adjustment, on line 1h. Also, enter the net section 481(a)

see section 5.05 in the Appendix of Rev. Proc. 2002-9 and Rev.

adjustment on line 25 in Part IV on page 3.

Proc. 2002-28.

The following example illustrates how an applicant calculates

the section 481(a) adjustment when changing to an accrual

Schedule B—Change in Reporting

method, a nonaccrual-experience method, and the recurring

Advance Payments

item exception.

Line 1. In general, advance payments must be included in

Example. ABC Corporation, a calendar year taxpayer using

gross income in the tax year of receipt. However, for federal

the cash method of accounting, has the following items of

income tax purposes, Rev. Proc. 2004-34, 2004-22 I.R.B. 991,

unreported income and expense on December 31, 2005:

allows applicants on the accrual method, in certain

circumstances, to defer to the next tax year amounts received

Accrued income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$250,000

(or amounts due and payable) that are attributable to a

Uncollectible amounts based on

subsequent tax year. Applicants requesting the deferral method

the nonaccrual-experience method . . . . . . . . . . . . .

50,000

under Rev. Proc. 2004-34 must provide the information and

documentation in section 8.03(2) of Rev. Proc. 2004-34 in lieu

Accrued amounts properly

of the information and documentation required by Line 1 of

deductible (economic performance has occurred) . . . .

75,000

Schedule B.

Expenses eligible for recurring item

exception . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5,000

Line 2. Advance payments received under a contract for the

sale of goods generally may be deferred for federal income tax

ABC Corporation changes to an overall accrual method, a

purposes until the second year following the receipt of

nonaccrual-experience method, and the recurring item

substantial advance payments on the contract. See Regulations

exception for calendar year 2006. The section 481(a)

section 1.451-5 for requirements that must be met and for the

adjustment is calculated as follows:

definition of “substantial advance payments.”

-7-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16