Instructions For Form 706-Na - United States Estate (And Generation-Skipping Transfer) Tax Return - Internal Revenue Service - 2006

ADVERTISEMENT

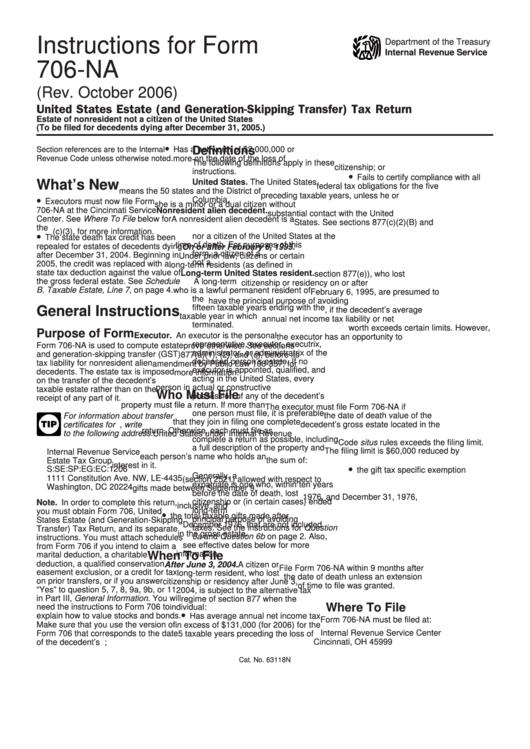

Instructions for Form

Department of the Treasury

Internal Revenue Service

706-NA

(Rev. October 2006)

United States Estate (and Generation-Skipping Transfer) Tax Return

Estate of nonresident not a citizen of the United States

(To be filed for decedents dying after December 31, 2005.)

•

Definitions

Section references are to the Internal

Has a net worth of $2,000,000 or

Revenue Code unless otherwise noted.

more on the date of the loss of U.S.

The following definitions apply in these

citizenship; or

instructions.

•

Fails to certify compliance with all

What’s New

United States. The United States

federal tax obligations for the five

means the 50 states and the District of

preceding taxable years, unless he or

•

Columbia.

Executors must now file Form

she is a minor or a dual citizen without

706-NA at the Cincinnati Service

Nonresident alien decedent.

substantial contact with the United

Center. See Where To File below for

A nonresident alien decedent is a

States. See sections 877(c)(2)(B) and

the address.

decedent who is neither domiciled in

(c)(3), for more information.

•

nor a citizen of the United States at the

The state death tax credit has been

time of death. For purposes of this

repealed for estates of decedents dying

On or after February 6, 1995.

form, a citizen of a U.S. possession is

after December 31, 2004. Beginning in

Under prior law, citizens or certain

not a U.S. citizen.

2005, the credit was replaced with a

long-term residents (as defined in

state tax deduction against the value of

Long-term United States resident.

section 877(e)), who lost U.S.

the gross federal estate. See Schedule

A long-term U.S. resident is an alien

citizenship or residency on or after

B. Taxable Estate, Line 7, on page 4.

who is a lawful permanent resident of

February 6, 1995, are presumed to

the U.S. in at least eight of the last

have the principal purpose of avoiding

fifteen taxable years ending with the

General Instructions

U.S. taxes, if the decedent’s average

taxable year in which U.S. residency is

annual net income tax liability or net

terminated.

worth exceeds certain limits. However,

Purpose of Form

Executor. An executor is the personal

the executor has an opportunity to

representative, executor, executrix,

Form 706-NA is used to compute estate

prove otherwise. See sections

administrator, or administratrix of the

and generation-skipping transfer (GST)

877(a)(1), (2), and (c), before its

deceased person’s estate. If no

tax liability for nonresident alien

amendment by Public Law 108-357, for

executor is appointed, qualified, and

decedents. The estate tax is imposed

more information.

acting in the United States, every

on the transfer of the decedent’s

person in actual or constructive

taxable estate rather than on the

Who Must File

possession of any of the decedent’s

receipt of any part of it.

property must file a return. If more than

The executor must file Form 706-NA if

one person must file, it is preferable

the date of death value of the

For information about transfer

that they join in filing one complete

TIP

decedent’s gross estate located in the

certificates for U.S. assets, write

return. Otherwise, each must file as

to the following address:

United States under Internal Revenue

complete a return as possible, including

Code situs rules exceeds the filing limit.

a full description of the property and

The filing limit is $60,000 reduced by

Internal Revenue Service

each person’s name who holds an

the sum of:

Estate Tax Group

interest in it.

•

S:SE:SP:EG:EC:1206

the gift tax specific exemption

U.S. expatriate. Generally, a U.S.

1111 Constitution Ave. NW, LE-4435

(section 2521) allowed with respect to

expatriate is one who, within ten years

Washington, DC 20224

gifts made between September 9,

before the date of death, lost U.S.

1976, and December 31, 1976,

citizenship or (in certain cases) ended

Note. In order to complete this return,

inclusive, and

long-term U.S. residency with the

you must obtain Form 706, United

•

the total taxable gifts made after

principal purpose of avoiding U.S.

States Estate (and Generation-Skipping

December 1976, that are not included

taxes. See the instructions for Question

Transfer) Tax Return, and its separate

in the gross estate.

6a and Question 6b on page 2. Also,

instructions. You must attach schedules

see effective dates below for more

from Form 706 if you intend to claim a

information.

When To File

marital deduction, a charitable

deduction, a qualified conservation

After June 3, 2004. A citizen or

File Form 706-NA within 9 months after

easement exclusion, or a credit for tax

long-term resident, who lost U.S.

the date of death unless an extension

on prior transfers, or if you answer

citizenship or residency after June 3,

of time to file was granted.

“Yes” to question 5, 7, 8, 9a, 9b, or 11

2004, is subject to the alternative tax

in Part III, General Information. You will

regime of section 877 when the

Where To File

need the instructions to Form 706 to

individual:

•

explain how to value stocks and bonds.

Has average annual net income tax

Form 706-NA must be filed at:

Make sure that you use the version of

in excess of $131,000 (for 2006) for the

Internal Revenue Service Center

Form 706 that corresponds to the date

5 taxable years preceding the loss of

Cincinnati, OH 45999

of the decedent’s death.

U.S. citizenship;

Cat. No. 63118N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5