Instructions For Form 940-Ez - Employer'S Annual Federal Unemployment (Futa) Tax Return - Internal Revenue Service - 2003

ADVERTISEMENT

03

2 0

Department of the Treasury

Internal Revenue Service

Instructions for

Form 940-EZ

Employer’s Annual Federal Unemployment

(FUTA) Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

Items To Note

General Instructions

Electronic deposit requirement. You may be required

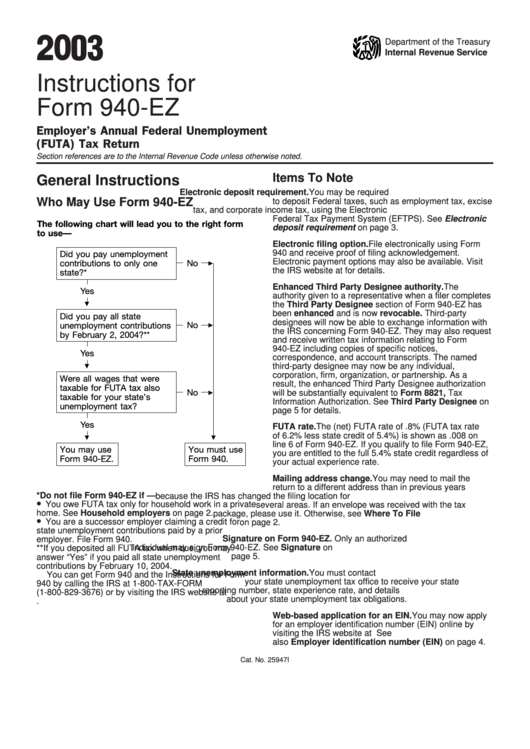

Who May Use Form 940-EZ

to deposit Federal taxes, such as employment tax, excise

tax, and corporate income tax, using the Electronic

Federal Tax Payment System (EFTPS). See Electronic

The following chart will lead you to the right form

deposit requirement on page 3.

to use—

Electronic filing option. File electronically using Form

940 and receive proof of filing acknowledgement.

Did you pay unemployment

Electronic payment options may also be available. Visit

No

contributions to only one

the IRS website at for details.

state?*

Enhanced Third Party Designee authority. The

Yes

authority given to a representative when a filer completes

the Third Party Designee section of Form 940-EZ has

been enhanced and is now revocable. Third-party

Did you pay all state

designees will now be able to exchange information with

No

unemployment contributions

the IRS concerning Form 940-EZ. They may also request

by February 2, 2004?**

and receive written tax information relating to Form

940-EZ including copies of specific notices,

Yes

correspondence, and account transcripts. The named

third-party designee may now be any individual,

corporation, firm, organization, or partnership. As a

Were all wages that were

result, the enhanced Third Party Designee authorization

taxable for FUTA tax also

No

will be substantially equivalent to Form 8821, Tax

taxable for your state’s

Information Authorization. See Third Party Designee on

unemployment tax?

page 5 for details.

Yes

FUTA rate. The (net) FUTA rate of .8% (FUTA tax rate

of 6.2% less state credit of 5.4%) is shown as .008 on

line 6 of Form 940-EZ. If you qualify to file Form 940-EZ,

You may use

You must use

you are entitled to the full 5.4% state credit regardless of

Form 940-EZ.

Form 940.

your actual experience rate.

Mailing address change. You may need to mail the

return to a different address than in previous years

*Do not file Form 940-EZ if —

because the IRS has changed the filing location for

•

You owe FUTA tax only for household work in a private

several areas. If an envelope was received with the tax

home. See Household employers on page 2.

package, please use it. Otherwise, see Where To File

•

You are a successor employer claiming a credit for

on page 2.

state unemployment contributions paid by a prior

Signature on Form 940-EZ. Only an authorized

employer. File Form 940.

individual may sign Form 940-EZ. See Signature on

**If you deposited all FUTA tax when due, you may

page 5.

answer “Yes” if you paid all state unemployment

contributions by February 10, 2004.

State unemployment information. You must contact

You can get Form 940 and the Instructions for Form

your state unemployment tax office to receive your state

940 by calling the IRS at 1-800-TAX-FORM

reporting number, state experience rate, and details

(1-800-829-3676) or by visiting the IRS website at

about your state unemployment tax obligations.

Web-based application for an EIN. You may now apply

for an employer identification number (EIN) online by

visiting the IRS website at See

also Employer identification number (EIN) on page 4.

Cat. No. 25947I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7