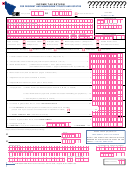

Form 1041me - Income Tax Return For Resident And Nonresident Estates And Trusts - 2009 Page 2

ADVERTISEMENT

FORM 1041ME, page 2

-

Enclose with your Form 1041ME

SCHEDULE 1 - Fiduciary Adjustment

99

(Enter combined amounts for both the benefi ciaries and the estate or trust)

*0909101*

1 ADDITIONS — Income exempt from federal income tax, but taxable by Maine:

,

.00

a Income from municipal and state bonds, other than Maine .....................................................................................1a

,

.00

b Net Operating Loss Adjustment (attach schedule) ..................................................................................................1b

,

.00

c Maine Public Employees Retirement System Contributions ................................................................................... 1c

,

.00

d Domestic Production Activities Deduction Add-back (see instructions) ...................................................................1d

,

.00

e Bonus Depreciation and IRC § 179 Expense Add-back (see instructions) .............................................................1e

,

.00

f Discharge of Indebtedness deferred for federal tax purposes .................................................................................1f

,

.00

g Other. List

_________________________ (see instructions) ..............................................................................1g

,

.00

h Total additions (add lines 1a through 1g) ................................................................................................................1h

2 DEDUCTIONS — Income exempt from Maine income tax, but taxable by federal law:

,

.00

a U.S. Government Bond interest included in federal taxable income .......................................................................2a

,

.00

b Social Security and Railroad Retirement Benefi ts included in federal taxable income (see instructions) ...............2b

c Interest from Maine Municipal General

Obligation,

Private Activity and Airport Authority Bonds included in

,

.00

federal taxable income .............................................................................................................................................. 2c

d Maine Public Employees Retirement System Pick-Up Contributions paid during 2009 which have been

,

.00

previously taxed by the state ...................................................................................................................................2d

,

.00

e Contributions to Qualifi ed Tuition Programs - 529 Plans (see instructions) ............................................................2e

,

.00

f Bonus Depreciation and IRC § 179 Recapture (see instructions) ............................................................................2f

,

.00

g Other. List ______________________________________ (see instructions) .....................................................2g

,

.00

h Total Deductions (add lines 2a through 2g) .............................................................................................................2h

,

.00

3 Net Fiduciary Adjustment (subtract line 2h from line 1h — see instructions [may be a negative amount]) ...............3

All estates or trusts: Multiply line 3 by Schedule 2, Column 3, line f. Resident estates or trusts: Enter on page 1, line 2.

Nonresident estates or trusts: Enter on Schedule NR, line 7, Column A.

SCHEDULE 2 — Allocation of Federal Income and Maine-source Income

1. Name

2. Share of income

3. Percent

4. State of

5. Social security

6. Maine-source income allocated

B = benefi ciary

(copy from federal return)

domicile

number/EIN of

to nonresident & “Safe

E/T = estate or trust

benefi ciaries

Harbor” resident benefi ciaries

(a) B-

$

%

$

(b) B-

$

%

$

(c) B-

$

%

$

(d) B-

$

%

$

(e) B-

$

%

$

(f) E/T-

$

%

(g) Total

$

100%

$

Line g, Column 6: If required to complete Schedule NR, enter the amount from Schedule NR, line 4, Column B. Complete Column 6 for nonresident

and “Safe Harbor” resident benefi ciaries based on the amount entered on line g, Column 6, and also based on the percentages in Column 3.

SCHEDULE 3 - Credir for Income Tax Paid to Another Jurisdiction

,

1 Maine taxable income from Form 1041ME, page 1, line 3 ............................................................................................1

.00

,

2 Income taxed by ( _______________________________ other jurisdiction) included in line 1 ..................................2

.00

3 Percentage of income taxed by other jurisdiction (divide line 2 by line 1) .....................................................................3

____________________%

4 Limitation of credit:

,

a Form 1041ME, page 1, line 4 $ ____________ multiplied by ________ % on line 3 above ..................................4a

.00

,

b Income taxes paid to other jurisdiction net of tax credits .........................................................................................4b

.00

,

5 Allowable credit: line 4a or 4b, whichever is less. Enter here and on Form 1041ME, Schedule A, line 4 ....................5

.00

Special instructions for taxpayers who claim credit for income tax paid to more than one other jurisdiction: Credit for each jurisdiction must be computed separately.

Use a separate Schedule 3 for each one. Add the results together and enter total on Schedule A, line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2