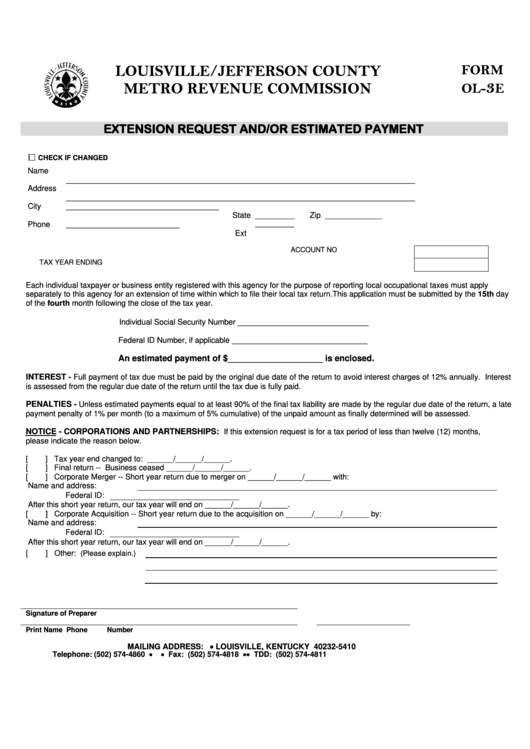

LOUISVILLE/JEFFERSON COUNTY

FORM

3

METRO REVENUE COMMISSION

OL-

E

EXTENSION REQUEST AND/OR ESTIMATED PAYMENT

CHECK IF CHANGED

Name

________________________________________________________________________________

Address

________________________________________________________________________________

City

___________________________________

State _________

Zip _____________

__________

Phone

__________________________

Ext

ACCOUNT NO

TAX YEAR ENDING

Each individual taxpayer or business entity registered with this agency for the purpose of reporting local occupational taxes must apply

separately to this agency for an extension of time within which to file their local tax return. This application must be submitted by the 15th day

of the fourth month following the close of the tax year.

Individual Social Security Number ______________________________

Federal ID Number, if applicable _______________________________

An estimated payment of $____________________ is enclosed.

INTEREST

- Full payment of tax due must be paid by the original due date of the return to avoid interest charges of 12% annually. Interest

is assessed from the regular due date of the return until the tax due is fully paid.

PENALTIES

- Unless estimated payments equal to at least 90% of the final tax liability are made by the regular due date of the return, a late

payment penalty of 1% per month (to a maximum of 5% cumulative) of the unpaid amount as finally determined will be assessed.

NOTICE - CORPORATIONS AND PARTNERSHIPS:

If this extension request is for a tax period of less than twelve (12) months,

please indicate the reason below.

[

] Tax year end changed to: ______/______/______.

[

] Final return -- Business ceased ______/______/______.

[

] Corporate Merger -- Short year return due to merger on ______/______/______ with:

Name and address:

Federal ID:

After this short year return, our tax year will end on ______/______/______.

[

] Corporate Acquisition -- Short year return due to the acquisition on ______/______/______ by:

Name and address:

Federal ID:

After this short year return, our tax year will end on ______/______/______.

[

] Other:

(Please explain.)

Signature of Preparer

Print Name

Phone Number

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 •

• Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1