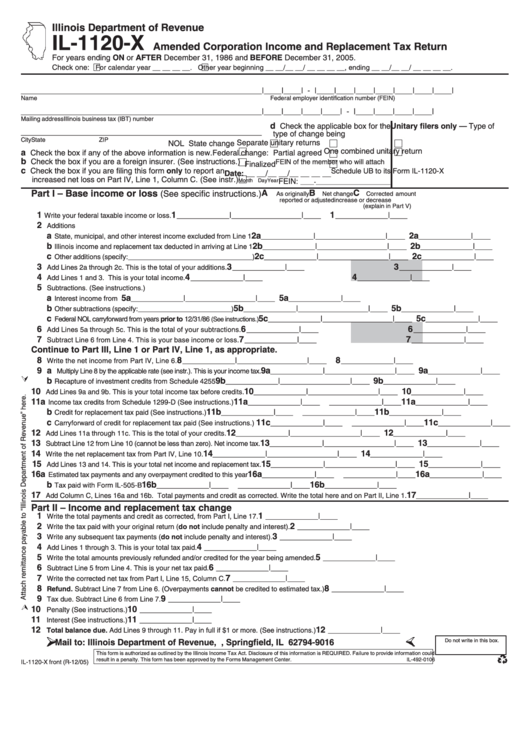

Form Il-1120-X - Amended Corporation Income And Replacement Tax Return

ADVERTISEMENT

Illinois Department of Revenue

IL-1120-X

Amended Corporation Income and Replacement Tax Return

For years ending ON or AFTER December 31, 1986 and BEFORE December 31, 2005.

Check one:

For calendar year __ __ __ __.

Other year beginning __ __/__ __/ __ __ __ __, ending __ __/__ __/ __ __ __ __.

_______________________________________________________

|____|____| - |____|____|____|____|____|____|____|

Name

Federal employer identification number (FEIN)

_______________________________________________________

|____|____|____|____| - |____|____|____|____|

Mailing address

Illinois business tax (IBT) number

d

Check the applicable box for the Unitary filers only — Type of

_______________________________________________________

type of change being made.

unitary return previously filed

City

State

ZIP

Separate unitary returns

NOL

State change

One combined unitary return

a

Check the box if any of the above information is new.

Federal change:

Partial agreed

b

Check the box if you are a foreign insurer. (See instructions.)

FEIN of the member who will attach

Finalized

c

Check the box if you are filing this form only to report an

Schedule UB to its Form IL-1120-X

Date: __ __/__ __/__ __ __ __

increased net loss on Part IV, Line 1, Column C. (See instr.)

FEIN:

Month Day

Year

____-______________________

Part I – Base income or loss

A

B

C

(See specific instructions.)

As originally

Net change

Corrected amount

reported or adjusted

increase or decrease

(explain in Part V)

1

1

1

____________|____

____________|____

____________|____

Write your federal taxable income or loss.

2

Additions

a

2a

2a

____________|____

____________|____

____________|____

State, municipal, and other interest income excluded from Line 1

b

2b

2b

____________|____

____________|____

____________|____

Illinois income and replacement tax deducted in arriving at Line 1

c

2c

2c

____________|____

____________|____

____________|____

Other additions (specify:________________________________)

3

3

3

____________|____

____________|____

Add Lines 2a through 2c. This is the total of your additions.

4

4

4

____________|____

____________|____

Add Lines 1 and 3. This is your total income.

5

Subtractions. (See instructions.)

a

5a

5a

____________|____

____________|____

____________|____

Interest income from U.S. Treasury and exempt federal obligations

b

5b

5b

____________|____

____________|____

____________|____

Other subtractions (specify:________________________)

c

5c

5c

____________|____

____________|____

____________|____

Federal NOL carryforward from years prior to 12/31/86

(See instructions.)

6

6

6

____________|____

____________|____

Add Lines 5a through 5c. This is the total of your subtractions.

7

7

7

____________|____

____________|____

Subtract Line 6 from Line 4. This is your base income or loss.

Continue to Part III, Line 1 or Part IV, Line 1, as appropriate.

8

8

8

____________|____

____________|____

____________|____

Write the net income from Part IV, Line 6.

9 a

9a

9a

____________|____

____________|____

____________|____

Multiply Line 8 by the applicable rate (see instr.). This is your income tax.

b

9b

9b

____________|____

____________|____

____________|____

Recapture of investment credits from Schedule 4255

10

10

10

____________|____

____________|____

____________|____

Add Lines 9a and 9b. This is your total income tax before credits.

11 a

11a

11a

____________|____

____________|____

____________|____

Income tax credits from Schedule 1299-D (See instructions.)

b

11b

11b

____________|____

____________|____

____________|____

Credit for replacement tax paid (See instructions.)

c

11c

11c

____________|____

____________|____

____________|____

Carryforward of credit for replacement tax paid (See instructions.)

12

12

12

____________|____

____________|____

____________|____

Add Lines 11a through 11c. This is the total of your credits.

13

13

13

____________|____

____________|____

____________|____

Subtract Line 12 from Line 10 (cannot be less than zero). Net income tax.

14

14

14

____________|____

____________|____

____________|____

Write the net replacement tax from Part IV, Line 10.

15

15

15

____________|____

____________|____

____________|____

Add Lines 13 and 14. This is your total net income and replacement tax.

16 a

16a

16a

____________|____

____________|____

____________|____

Estimated tax payments and any overpayment credited to this year

b

16b

16b

____________|____

____________|____

____________|____

Tax paid with Form IL-505-B

17

17

____________|____

Add Column C, Lines 16a and 16b. Total payments and credit as corrected. Write the total here and on Part II, Line 1.

Part II – Income and replacement tax change

1

1

____________|____

Write the total payments and credit as corrected, from Part I, Line 17.

2

2

____________|____

Write the tax paid with your original return (do not include penalty and interest).

3

3

____________|____

Write any subsequent tax payments (do not include penalty and interest).

4

4

____________|____

Add Lines 1 through 3. This is your total tax paid.

5

5

____________|____

Write the total amounts previously refunded and/or credited for the year being amended.

6

6

____________|____

Subtract Line 5 from Line 4. This is your net tax paid.

7

7

____________|____

Write the corrected net tax from Part I, Line 15, Column C.

8

8

____________|____

Refund. Subtract Line 7 from Line 6. (Overpayments cannot be credited to estimated tax.)

9

9

____________|____

Tax due. Subtract Line 6 from Line 7.

10

10

____________|____

Penalty (See instructions.)

11

11

____________|____

Interest (See instructions.)

12

12

____________|____

Total balance due. Add Lines 9 through 11. Pay in full if $1 or more. (See instructions.)

Do not write in this box.

Mail to: Illinois Department of Revenue, P.O. Box 19016, Springfield, IL 62794-9016

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0106

IL-1120-X front (R-12/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2