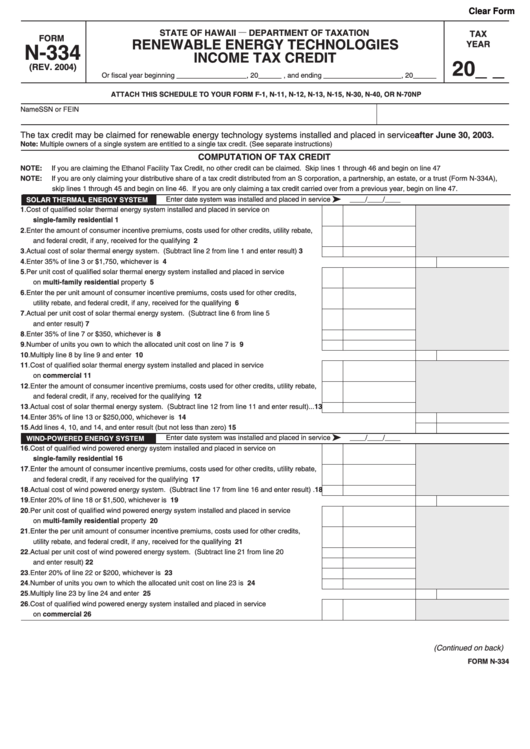

Clear Form

__

STATE OF HAWAII

DEPARTMENT OF TAXATION

TAX

FORM

RENEWABLE ENERGY TECHNOLOGIES

YEAR

N-334

INCOME TAX CREDIT

20_ _

(REV. 2004)

Or fiscal year beginning __________________, 20______ , and ending ____________________, 20______

ATTACH THIS SCHEDULE TO YOUR FORM F-1, N-11, N-12, N-13, N-15, N-30, N-40, OR N-70NP

Name

SSN or FEIN

The tax credit may be claimed for renewable energy technology systems installed and placed in service after June 30, 2003.

Note: Multiple owners of a single system are entitled to a single tax credit. (See separate instructions)

COMPUTATION OF TAX CREDIT

NOTE:

If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed. Skip lines 1 through 46 and begin on line 47

NOTE:

If you are only claiming your distributive share of a tax credit distributed from an S corporation, a partnership, an estate, or a trust (Form N-334A),

skip lines 1 through 45 and begin on line 46. If you are only claiming a tax credit carried over from a previous year, begin on line 47.

ä

Enter date system was installed and placed in service

____/____/____

SOLAR THERMAL ENERGY SYSTEM

1. Cost of qualified solar thermal energy system installed and placed in service on

single-family residential property............................................................................................

1

2. Enter the amount of consumer incentive premiums, costs used for other credits, utility rebate,

and federal credit, if any, received for the qualifying system .....................................................

2

3. Actual cost of solar thermal energy system. (Subtract line 2 from line 1 and enter result).......

3

4. Enter 35% of line 3 or $1,750, whichever is less........................................................................................................................

4

5. Per unit cost of qualified solar thermal energy system installed and placed in service

on multi-family residential property ........................................................................................

5

6. Enter the per unit amount of consumer incentive premiums, costs used for other credits,

utility rebate, and federal credit, if any, received for the qualifying system................................

6

7. Actual per unit cost of solar thermal energy system. (Subtract line 6 from line 5

and enter result).........................................................................................................................

7

8. Enter 35% of line 7 or $350, whichever is less ..........................................................................

8

9. Number of units you own to which the allocated unit cost on line 7 is applicable......................

9

10. Multiply line 8 by line 9 and enter result .....................................................................................................................................

10

11. Cost of qualified solar thermal energy system installed and placed in service

on commercial property............................................................................................................

11

12. Enter the amount of consumer incentive premiums, costs used for other credits, utility rebate,

and federal credit, if any, received for the qualifying system .....................................................

12

13. Actual cost of solar thermal energy system. (Subtract line 12 from line 11 and enter result) ...

13

14. Enter 35% of line 13 or $250,000, whichever is less..................................................................................................................

14

15. Add lines 4, 10, and 14, and enter result (but not less than zero)..............................................................................................

15

ä

Enter date system was installed and placed in service

____/____/____

WIND-POWERED ENERGY SYSTEM

16. Cost of qualified wind powered energy system installed and placed in service on

single-family residential property............................................................................................

16

17. Enter the amount of consumer incentive premiums, costs used for other credits, utility rebate,

and federal credit, if any received for the qualifying system ......................................................

17

18. Actual cost of wind powered energy system. (Subtract line 17 from line 16 and enter result) .

18

19. Enter 20% of line 18 or $1,500, whichever is less......................................................................................................................

19

20. Per unit cost of qualified wind powered energy system installed and placed in service

on multi-family residential property ........................................................................................

20

21. Enter the per unit amount of consumer incentive premiums, costs used for other credits,

utility rebate, and federal credit, if any, received for the qualifying system................................

21

22. Actual per unit cost of wind powered energy system. (Subtract line 21 from line 20

and enter result).........................................................................................................................

22

23. Enter 20% of line 22 or $200, whichever is less ........................................................................

23

24. Number of units you own to which the allocated unit cost on line 23 is applicable....................

24

25. Multiply line 23 by line 24 and enter result .................................................................................................................................

25

26. Cost of qualified wind powered energy system installed and placed in service

on commercial property............................................................................................................

26

(Continued on back)

FORM N-334

1

1 2

2