Instructions For Mineral Severance Tax Schedule M-1 A/b - Parish Detail

ADVERTISEMENT

Instructions for Mineral Severance Tax Schedule M-1 A/B

Parish Detail

Mineral Resource in which the tax paid herewith or to be paid by others

This return must be filed with the Mineral – Parish Summary Return, form number R-9000, and is due on or

before the last day of the month following the month of the severance of the mineral resource.

Name and address or reporting company – Self- explanatory.

Revenue Account Number – This is your 10 digit Louisiana Tax Number.

Taxable period – Period for which the tax is due. Volumes and taxes for more than one taxable period are not to be

combined; they are to be reported separately.

Schedule A – All resources severed and/ or purchased on which severance tax is being paid with this form.

Name and address of severer and or purchaser – Name and address for those in which you are remitting tax.

Resource Severed – see the table below for the name of the resource.

Resource Code Number – see the table below for the resource code.

Name of pit lease or mine location – Identify location of mineral resource product.

Parish code – parish number assigned by the Louisiana Department of Revenue that Identifies the parish from which

the timber product was severed. A list of the parish Codes can be obtained by contacting the Taxpayer Services

Division, Severance Tax Section of the Louisiana Department of Revenue.

Quantity severed or purchased – The amount of the mineral resource for which you are remitting tax .

Tax rate – Refer to the table below for the applicable tax rate.

Penalty and Interest – Amount of penalty and interest determined to be due.

Total amount due – Total tax, penalty, and interest for the taxable period that are applicable to this line.

Schedule B – List all resources severed and /or purchased on which others are to pay severance tax.

Resource Severed – see that table below for the name of the resource.

Resource Code Number – see the table for the resource code.

Parish Code – Parish number assigned by the Louisiana Department of Revenue that identifies the parish from which

the timber product was severed. A list of the parish codes can be obtained by contacting the Taxpayer Services

Division, Severance Tax Section of the Louisiana Department of Revenue.

Quantity Severed – The amount of the mineral resource severed for which others are to remit tax.

Quantity Purchased – The amount of the mineral resource purchased for which others are to remit tax.

Name of Taxpayer – name of those who will remit the tax.

Address of Taxpayer – Address of those who will remit the tax.

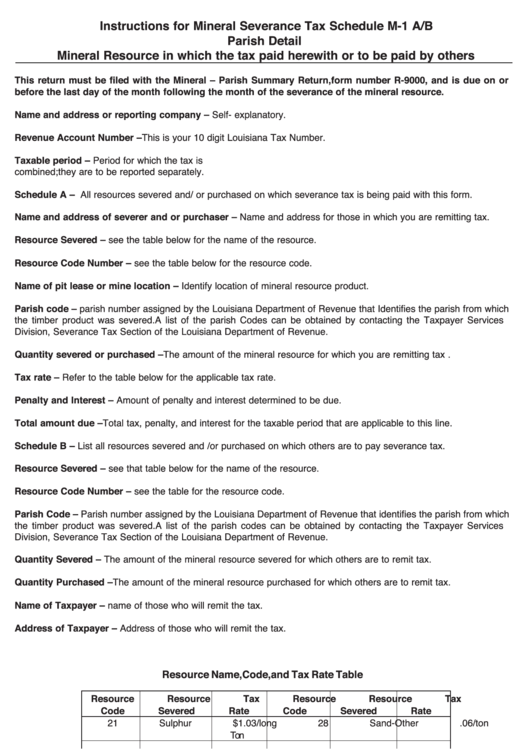

Resource Name, Code, and Tax Rate Table

Resource

Resource

Tax

Resource

Resource

Tax

Code

Severed

Rate

Code

Severed

Rate

21

Sulphur

$1.03/long

28

Sand-Other

.06/ton

Ton

22

Salt

.06/ton

29

Shell – reef

.06/ton

or oyster

23

Salt Brine

.005/ton

30

Shell – clam

.06/ton

25

Sand- Clay

.06/ton

31

Stone

.03/ton

or Pit Run

Crushed

26

Sand-Washed

.06/ton

32

Marble

.20/ton

27

Sand- River

.06/ton

33

Lignite

.12/ton

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1