Instructions For Form 8040 - Sales/use Tax,parking Tax,amusement Tax Return

ADVERTISEMENT

SECTION S - SALES/USE TAX

SALES/USE TAX

Line S1. GROSS SALES: Enter total amount of all taxable and

PARKING TAX

nontaxable sales, leases, rentals and services. The sale of services

AMUSEMENT TAX

means:

RETURN

c

sale of admissions, dues and fees to places of amusement,

athletic and recreational events;

FORM 8040

c

storage or parking privileges at hotels and parking lots;

INSTRUCTIONS

c

printing or overprinting, lithographing, or other similar

services of reproduction of written or graphic matter;

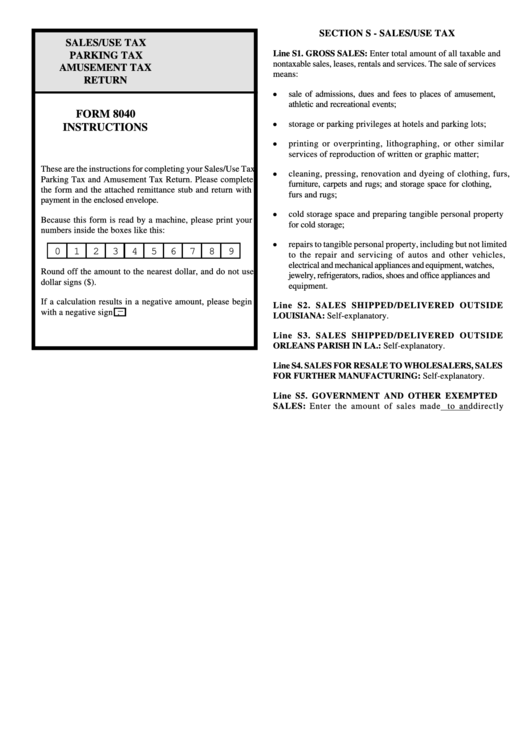

These are the instructions for completing your Sales/Use Tax,

c

cleaning, pressing, renovation and dyeing of clothing, furs,

Parking Tax and Amusement Tax Return. Please complete

furniture, carpets and rugs; and storage space for clothing,

the form and the attached remittance stub and return with

furs and rugs;

payment in the enclosed envelope.

c

cold storage space and preparing tangible personal property

Because this form is read by a machine, please print your

for cold storage;

numbers inside the boxes like this:

c

repairs to tangible personal property, including but not limited

0

1

2

3

4

5

6

7

8

9

to the repair and servicing of autos and other vehicles,

electrical and mechanical appliances and equipment, watches,

Round off the amount to the nearest dollar, and do not use

jewelry, refrigerators, radios, shoes and office appliances and

dollar signs ($).

equipment.

If a calculation results in a negative amount, please begin

Line S2. SALES SHIPPED/DELIVERED OUTSIDE

1

with a negative sign

.

LOUISIANA: Self-explanatory.

Line S3. SALES SHIPPED/DELIVERED OUTSIDE

ORLEANS PARISH IN LA.: Self-explanatory.

Line S4. SALES FOR RESALE TO WHOLESALERS, SALES

FOR FURTHER MANUFACTURING: Self-explanatory.

Line S5. GOVERNMENT AND OTHER EXEMPTED

SALES: Enter the amount of sales made

directly

to and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4