Instructions For Completing Schedule Of Disbursements Schedules 5 - 10 Form

ADVERTISEMENT

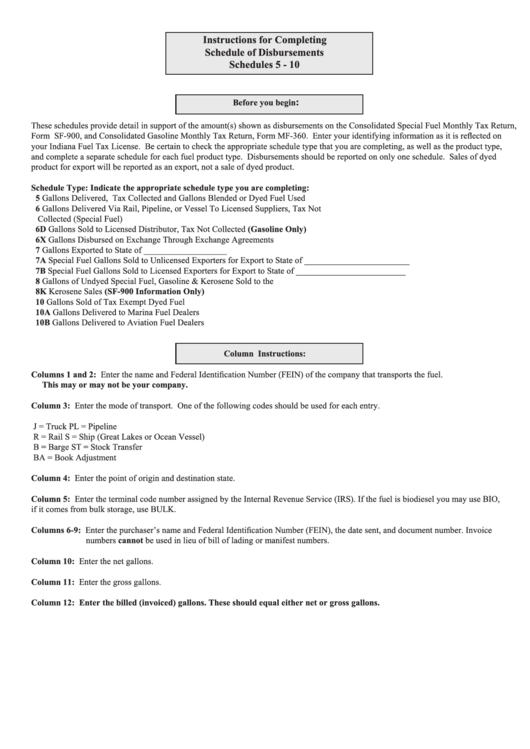

Instructions for Completing

Schedule of Disbursements

Schedules 5 - 10

:

Before you begin

These schedules provide detail in support of the amount(s) shown as disbursements on the Consolidated Special Fuel Monthly Tax Return,

Form SF-900, and Consolidated Gasoline Monthly Tax Return, Form MF-360. Enter your identifying information as it is reflected on

your indiana Fuel Tax License. Be certain to check the appropriate schedule type that you are completing, as well as the product type,

and complete a separate schedule for each fuel product type. Disbursements should be reported on only one schedule. Sales of dyed

product for export will be reported as an export, not a sale of dyed product.

Schedule Type: Indicate the appropriate schedule type you are completing:

5

Gallons Delivered, Tax Collected and Gallons Blended or Dyed Fuel Used

6

Gallons Delivered Via Rail, Pipeline, or Vessel To Licensed Suppliers, Tax not

Collected (Special Fuel)

6D

Gallons Sold to Licensed Distributor, Tax not Collected (Gasoline Only)

6X

Gallons Disbursed on exchange Through exchange Agreements

7

Gallons exported to State of ___________________

7A

Special Fuel Gallons Sold to Unlicensed exporters for export to State of ________________________

7B

Special Fuel Gallons Sold to Licensed exporters for export to State of _________________________

8

Gallons of Undyed Special Fuel, Gasoline & Kerosene Sold to the U.S. Government - Tax exempt

8K

Kerosene Sales (SF-900 Information Only)

10

Gallons Sold of Tax exempt Dyed Fuel

10A

Gallons Delivered to Marina Fuel Dealers

10B

Gallons Delivered to Aviation Fuel Dealers

Column Instructions:

Columns 1 and 2: Enter the name and Federal Identification Number (FEIN) of the company that transports the fuel.

This may or may not be your company.

Column 3: enter the mode of transport. One of the following codes should be used for each entry.

J

= Truck

PL = Pipeline

R

= Rail

S

= Ship (Great Lakes or Ocean Vessel)

B

= Barge

ST = Stock Transfer

BA

= Book Adjustment

Column 4: enter the point of origin and destination state.

Column 5: enter the terminal code number assigned by the internal Revenue Service (iRS). if the fuel is biodiesel you may use BiO,

if it comes from bulk storage, use BULK.

Columns 6-9: Enter the purchaser’s name and Federal Identification Number (FEIN), the date sent, and document number. Invoice

numbers cannot be used in lieu of bill of lading or manifest numbers.

Column 10: enter the net gallons.

Column 11: enter the gross gallons.

Column 12: Enter the billed (invoiced) gallons. These should equal either net or gross gallons.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1