Form Sv 3 - Ohio Severance Tax Return - Instructions

ADVERTISEMENT

SV 3 (Rev. 1/02)

Page 2

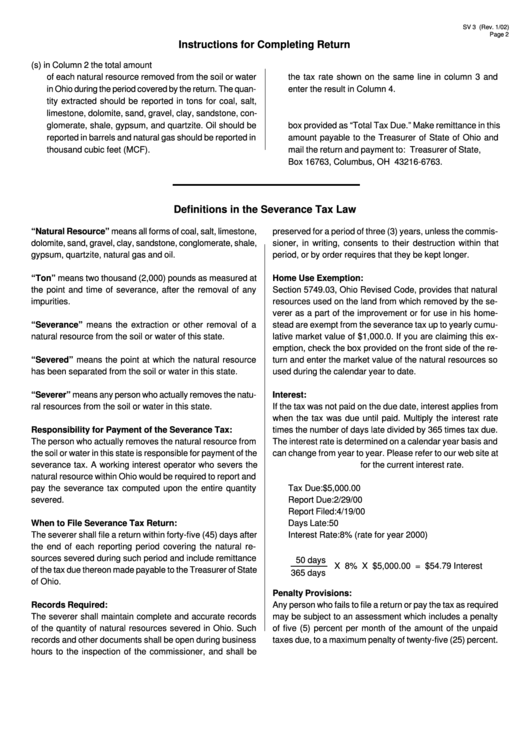

Instructions for Completing Return

1. Enter on the proper line(s) in Column 2 the total amount

2. Multiply the amount entered on each line in Column 2 by

of each natural resource removed from the soil or water

the tax rate shown on the same line in column 3 and

in Ohio during the period covered by the return. The quan-

enter the result in Column 4.

tity extracted should be reported in tons for coal, salt,

limestone, dolomite, sand, gravel, clay, sandstone, con-

3. Add the amounts entered in Column 4 and enter in the

glomerate, shale, gypsum, and quartzite. Oil should be

box provided as “Total Tax Due.” Make remittance in this

reported in barrels and natural gas should be reported in

amount payable to the Treasurer of State of Ohio and

thousand cubic feet (MCF).

mail the return and payment to: Treasurer of State, P.O.

Box 16763, Columbus, OH 43216-6763.

Definitions in the Severance Tax Law

“Natural Resource” means all forms of coal, salt, limestone,

preserved for a period of three (3) years, unless the commis-

dolomite, sand, gravel, clay, sandstone, conglomerate, shale,

sioner, in writing, consents to their destruction within that

gypsum, quartzite, natural gas and oil.

period, or by order requires that they be kept longer.

“Ton” means two thousand (2,000) pounds as measured at

Home Use Exemption:

the point and time of severance, after the removal of any

Section 5749.03, Ohio Revised Code, provides that natural

impurities.

resources used on the land from which removed by the se-

verer as a part of the improvement or for use in his home-

“Severance” means the extraction or other removal of a

stead are exempt from the severance tax up to yearly cumu-

natural resource from the soil or water of this state.

lative market value of $1,000.0. If you are claiming this ex-

emption, check the box provided on the front side of the re-

“Severed” means the point at which the natural resource

turn and enter the market value of the natural resources so

has been separated from the soil or water in this state.

used during the calendar year to date.

“Severer” means any person who actually removes the natu-

Interest:

ral resources from the soil or water in this state.

If the tax was not paid on the due date, interest applies from

when the tax was due until paid. Multiply the interest rate

Responsibility for Payment of the Severance Tax:

times the number of days late divided by 365 times tax due.

The person who actually removes the natural resource from

The interest rate is determined on a calendar year basis and

the soil or water in this state is responsible for payment of the

can change from year to year. Please refer to our web site at

severance tax. A working interest operator who severs the

for the current interest rate.

natural resource within Ohio would be required to report and

pay the severance tax computed upon the entire quantity

Tax Due:

$5,000.00

severed.

Report Due:

2/29/00

Report Filed:

4/19/00

When to File Severance Tax Return:

Days Late:

50

The severer shall file a return within forty-five (45) days after

Interest Rate:

8% (rate for year 2000)

the end of each reporting period covering the natural re-

sources severed during such period and include remittance

50 days

X 8% X $5,000.00 = $54.79 Interest

of the tax due thereon made payable to the Treasurer of State

365 days

of Ohio.

Penalty Provisions:

Records Required:

Any person who fails to file a return or pay the tax as required

The severer shall maintain complete and accurate records

may be subject to an assessment which includes a penalty

of the quantity of natural resources severed in Ohio. Such

of five (5) percent per month of the amount of the unpaid

records and other documents shall be open during business

taxes due, to a maximum penalty of twenty-five (25) percent.

hours to the inspection of the commissioner, and shall be

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1