RESET FIELDS

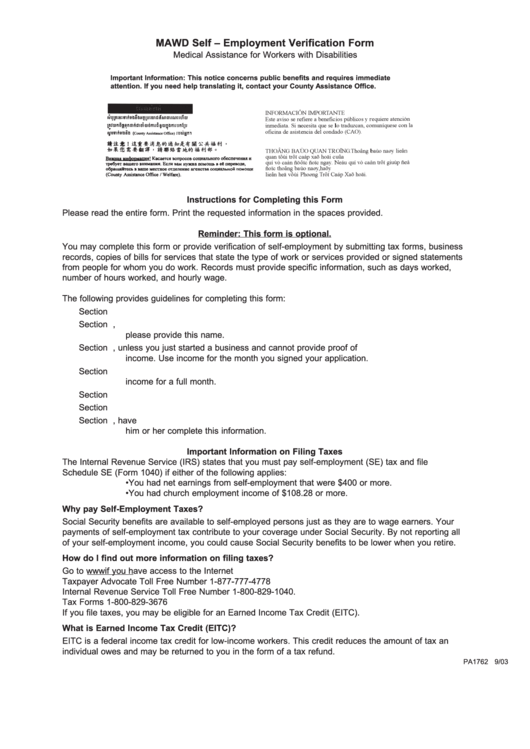

MAWD Self – Employment Verification Form

Medical Assistance for Workers with Disabilities

Important Information: This notice concerns public benefits and requires immediate

attention. If you need help translating it, contact your County Assistance Office.

Instructions for Completing this Form

Please read the entire form. Print the requested information in the spaces provided.

Reminder: This form is optional.

You may complete this form or provide verification of self-employment by submitting tax forms, business

records, copies of bills for services that state the type of work or services provided or signed statements

from people for whom you do work. Records must provide specific information, such as days worked,

number of hours worked, and hourly wage.

The following provides guidelines for completing this form:

Section A. Completed by the County Assistance Office.

Section B. Complete this section. Describe what you do. If your business has a company name,

please provide this name.

Section C. Complete this section, unless you just started a business and cannot provide proof of

income. Use income for the month you signed your application.

Section D. Complete if you just started a business and do not have proof of income. Estimate

income for a full month.

Section E. Complete if you file taxes. The date should reflect the last quarter/year you filed taxes.

Section F. Complete if you have business expenses. You must attach verification of all expenses.

Section G. This form must be signed and dated. If someone helped you complete this form, have

him or her complete this information.

Important Information on Filing Taxes

The Internal Revenue Service (IRS) states that you must pay self-employment (SE) tax and file

Schedule SE (Form 1040) if either of the following applies:

• You had net earnings from self-employment that were $400 or more.

• You had church employment income of $108.28 or more.

Why pay Self-Employment Taxes?

Social Security benefits are available to self-employed persons just as they are to wage earners. Your

payments of self-employment tax contribute to your coverage under Social Security. By not reporting all

of your self-employment income, you could cause Social Security benefits to be lower when you retire.

How do I find out more information on filing taxes?

Go to if you have access to the Internet

Taxpayer Advocate Toll Free Number 1-877-777-4778

Internal Revenue Service Toll Free Number 1-800-829-1040.

Tax Forms 1-800-829-3676

If you file taxes, you may be eligible for an Earned Income Tax Credit (EITC).

What is Earned Income Tax Credit (EITC)?

EITC is a federal income tax credit for low-income workers. This credit reduces the amount of tax an

individual owes and may be returned to you in the form of a tax refund.

PA 1762 9/03

1

1 2

2 3

3