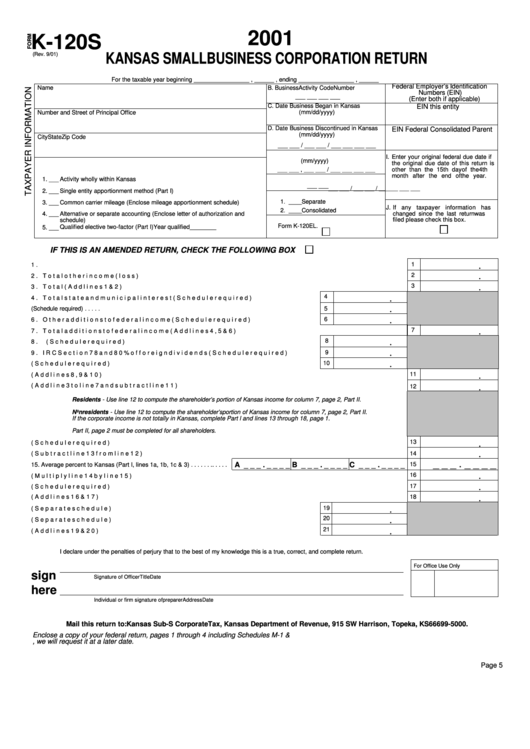

Form K-120s - Kansas Small Business Corporation Return - 2001

ADVERTISEMENT

2001

K-120S

(Rev. 9/01)

KANSAS SMALL BUSINESS CORPORATION RETURN

For the taxable year beginning _________________ , ______ , ending _________________ , ______

Federal Employer’s Identification

Name

B. Business Activity Code Number

Numbers (EIN)

___ ___ ___ ___

(Enter both if applicable)

C. Date Business Began in Kansas

EIN this entity

(mm/dd/yyyy)

Number and Street of Principal Office

D. Date Business Discontinued in Kansas

EIN Federal Consolidated Parent

(mm/dd/yyyy)

City

State

Zip Code

___ ___ / ___ ___ / ___ ___ ___ ___

E. State and Month/Year of Incorporation

I.

Enter your original federal due date if

(mm/yyyy)

the original due date of this return is

A. Method Used to Determine Income of Corporation in Kansas

___ ___ , ___ ___ / ___ ___ ___ ___

other than the 15th day of the 4th

month after the end of the year.

1. ___

Activity wholly within Kansas

F. State of Commercial Domicile

___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

2. ___

Single entity apportionment method (Part I)

G. Type of Federal Return Filed

1. ____ Separate

3. ___

Common carrier mileage (Enclose mileage apportionment schedule)

J.

If any taxpayer information has

2. ____ Consolidated

Alternative or separate accounting (Enclose letter of authorization and

changed since the last return was

4. ___

schedule)

H. Check the box if you have submitted a

filed please check this box.

Form K-120EL.

Qualified elective two-factor (Part I) Year qualified ________

5. ___

IF THIS IS AN AMENDED RETURN, CHECK THE FOLLOWING BOX

.

1

1. Federal ordinary income from federal Schedule K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

2

2. Total other income (loss) and deductions from federal Schedule K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.

3. Total (Add lines 1 & 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

4. Total state and municipal interest (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

5

5. Taxes on or measured by income or fees or payments in lieu of income taxes (Schedule required) . . . . .

.

6

6. Other additions to federal income (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

7

7. Total additions to federal income (Add lines 4, 5 & 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

8

8. Interest on obligations of the U.S. (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

9. IRC Section 78 and 80% of foreign dividends (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

.

10

10. Other subtractions from federal income (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

.

11. Total subtractions from federal income (Add lines 8, 9 & 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

12. Net income before apportionment (Add line 3 to line 7 and subtract line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Residents - Use line 12 to compute the shareholder’s portion of Kansas income for column 7, page 2, Part II.

Nonresidents - Use line 12 to compute the shareholder’s portion of Kansas income for column 7, page 2, Part II.

If the corporate income is not totally in Kansas, complete Part l and lines 13 through 18, page 1.

Part II, page 2 must be completed for all shareholders.

13

.

13. Nonbusiness income - Total company (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

14. Apportionable business income (Subtract line 13 from line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

_ _ _._ _ _ _

15. Average percent to Kansas (Part I, lines 1a, 1b, 1c & 3) . . . . . . . . . . . .

A _ _ _._ _ _ _

B _ _ _._ _ _ _

C _ _ _._ _ _ _

15

.

16

16. Amount to Kansas (Multiply line 14 by line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

17

17. Nonbusiness income - Kansas (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

18. Total Kansas income (Add lines 16 & 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

.

19. Estimated tax paid and credits (Separate schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

.

20. Other tax payments (Separate schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

.

21. Refund (Add lines 19 & 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare under the penalties of perjury that to the best of my knowledge this is a true, correct, and complete return.

For Office Use Only

sign

Signature of Officer

Title

Date

here

Individual or firm signature of preparer

Address

Date

Mail this return to: Kansas Sub-S Corporate Tax, Kansas Department of Revenue, 915 SW Harrison, Topeka, KS 66699-5000.

Enclose a copy of your federal return, pages 1 through 4 including Schedules M-1 & M-2. Also include any federal schedules to support any Kansas

modifications. No other forms or schedules are requested at this time. If additional information is necessary, we will request it at a later date.

Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2