Instructions For Form Ct-4804 - Transmittal Of Informational Returns Reported Magnetically (Continuation) - State Of Connecticut Department Of Revenue Services

ADVERTISEMENT

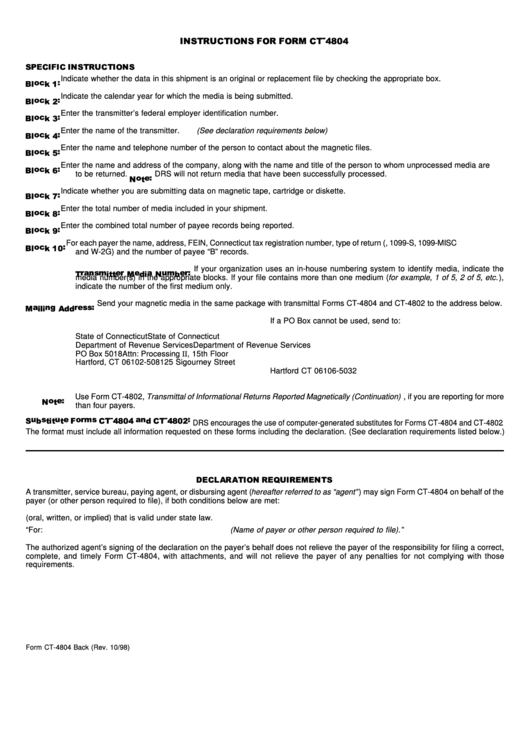

Indicate whether the data in this shipment is an original or replacement file by checking the appropriate box.

Indicate the calendar year for which the media is being submitted.

Enter the transmitter’s federal employer identification number.

Enter the name of the transmitter. (See declaration requirements below)

Enter the name and telephone number of the person to contact about the magnetic files.

Enter the name and address of the company, along with the name and title of the person to whom unprocessed media are

to be returned.

DRS will not return media that have been successfully processed.

Indicate whether you are submitting data on magnetic tape, cartridge or diskette.

Enter the total number of media included in your shipment.

Enter the combined total number of payee records being reported.

For each payer the name, address, FEIN, Connecticut tax registration number, type of return (e.g. 1099-R, 1099-S, 1099-MISC

and W-2G) and the number of payee “B” records.

If your organization uses an in-house numbering system to identify media, indicate the

media number(s) in the appropriate blocks. If your file contains more than one medium ( for example, 1 of 5, 2 of 5, etc. ),

indicate the number of the first medium only.

Send your magnetic media in the same package with transmittal Forms CT-4804 and CT-4802 to the address below.

If a PO Box cannot be used, send to:

State of Connecticut

State of Connecticut

Department of Revenue Services

Department of Revenue Services

PO Box 5018

Attn: Processing II, 15th Floor

Hartford, CT 06102-5081

25 Sigourney Street

Hartford CT 06106-5032

Use Form CT-4802, Transmittal of Informational Returns Reported Magnetically (Continuation) , if you are reporting for more

than four payers.

DRS encourages the use of computer-generated substitutes for Forms CT-4804 and CT-4802.

The format must include all information requested on these forms including the declaration. (See declaration requirements listed below.)

A transmitter, service bureau, paying agent, or disbursing agent ( hereafter referred to as “agent” ) may sign Form CT-4804 on behalf of the

payer (or other person required to file), if both conditions below are met:

1.

The agent has the authority to sign the form under an agency agreement (oral, written, or implied) that is valid under state law.

2.

The agent signs the form and adds the caption “For: (Name of payer or other person required to file). ”

The authorized agent’s signing of the declaration on the payer’s behalf does not relieve the payer of the responsibility for filing a correct,

complete, and timely Form CT-4804, with attachments, and will not relieve the payer of any penalties for not complying with those

requirements.

Form CT-4804 Back (Rev. 10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1