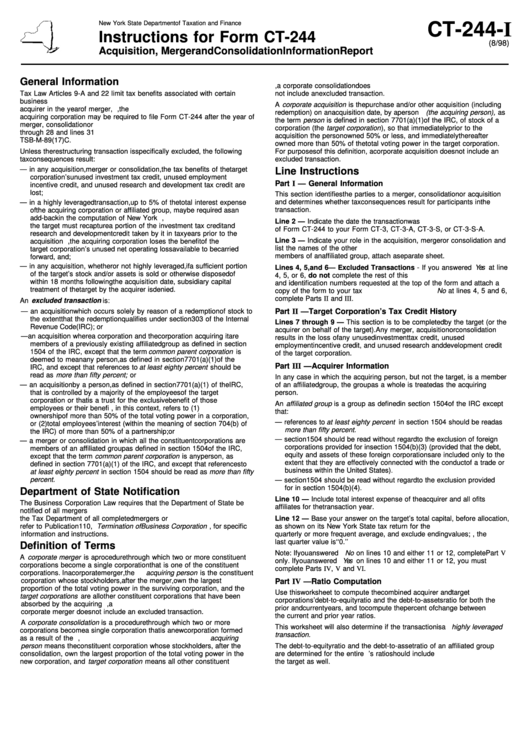

Instructions For Form Ct-244 - Acquisition, Merger And Consolidation Information Report - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-244-I

Instructions for Form CT-244

(8/98)

Acquisition, Merger and Consolidation Information Report

General Information

corporations. For purposes of this definition, a corporate consolidation does

Tax Law Articles 9-A and 22 limit tax benefits associated with certain

not include an excluded transaction.

business restructuring. Form CT-244 must be filed by both the target and

A corporate acquisition is the purchase and/or other acquisition (including

acquirer in the year of merger, consolidation or acquisition. In addition, the

redemption) on an acquisition date, by a person (the acquiring person), as

acquiring corporation may be required to file Form CT-244 after the year of

the term person is defined in section 7701(a)(1) of the IRC, of stock of a

merger, consolidation or acquisition. See the instructions for lines 17

corporation (the target corporation ), so that immediately prior to the

through 28 and lines 31 through 36. For additional information see

acquisition the person owned 50% or less, and immediately thereafter

TSB-M-89(17)C.

owned more than 50% of the total voting power in the target corporation.

Unless the restructuring transaction is specifically excluded, the following

For purposes of this definition, a corporate acquisition does not include an

tax consequences result:

excluded transaction.

— in any acquisition, merger or consolidation, the tax benefits of the target

Line Instructions

corporation’s unused investment tax credit, unused employment

Part I — General Information

incentive credit, and unused research and development tax credit are

lost;

This section identifies the parties to a merger, consolidation or acquisition

and determines whether tax consequences result for participants in the

— in a highly leveraged transaction, up to 5% of the total interest expense

transaction.

of the acquiring corporation or affiliated group, may be required as an

add-back in the computation of New York taxable income. In addition,

Line 2 — Indicate the date the transaction was completed. Attach a copy

the target must recapture a portion of the investment tax credit and

of Form CT-244 to your Form CT-3, CT-3-A, CT-3-S, or CT-3-S-A.

research and development credit taken by it in tax years prior to the

Line 3 — Indicate your role in the acquisition, merger or consolidation and

acquisition year. Also, the acquiring corporation loses the benefit of the

list the names of the other participants. If you need more room to list the

target corporation’s unused net operating loss available to be carried

members of an affiliated group, attach a separate sheet.

forward, and;

— in any acquisition, whether or not highly leveraged, if a sufficient portion

Lines 4, 5, and 6 — Excluded Transactions - If you answered Yes at line

of the target’s stock and/or assets is sold or otherwise disposed of

4, 5, or 6, do not complete the rest of this schedule. Provide the names

within 18 months following the acquisition date, subsidiary capital

and identification numbers requested at the top of the form and attach a

treatment of the target by the acquirer is denied.

copy of the form to your tax return. If you answered No at lines 4, 5 and 6,

complete Parts II and III.

An excluded transaction is:

— an acquisition which occurs solely by reason of a redemption of stock to

Part II — Target Corporation’s Tax Credit History

the extent that the redemption qualifies under section 303 of the Internal

Lines 7 through 9 — This section is to be completed by the target (or the

Revenue Code (IRC); or

acquirer on behalf of the target). Any merger, acquisition or consolidation

— an acquisition where a corporation and the corporation acquiring it are

results in the loss of any unused investment tax credit, unused

members of a previously existing affiliated group as defined in section

employment incentive credit, and unused research and development credit

1504 of the IRC, except that the term common parent corporation is

of the target corporation.

deemed to mean any person, as defined in section 7701(a)(1) of the

Part III — Acquirer Information

IRC, and except that references to at least eighty percent should be

read as more than fifty percent; or

In any case in which the acquiring person, but not the target, is a member

— an acquisition by a person, as defined in section 7701(a)(1) of the IRC,

of an affiliated group, the group as a whole is treated as the acquiring

that is controlled by a majority of the employees of the target

person.

corporation or that is a trust for the exclusive benefit of those

An affiliated group is a group as defined in section 1504 of the IRC except

employees or their beneficiaries. Control, in this context, refers to (1)

that:

ownership of more than 50% of the total voting power in a corporation,

— references to at least eighty percent in section 1504 should be read as

or (2) total employees’ interest (within the meaning of section 704(b) of

more than fifty percent.

the IRC) of more than 50% of a partnership; or

— section 1504 should be read without regard to the exclusion of foreign

— a merger or consolidation in which all the constituent corporations are

corporations provided for in section 1504(b)(3) (provided that the debt,

members of an affiliated group as defined in section 1504 of the IRC,

equity and assets of these foreign corporations are included only to the

except that the term common parent corporation is any person, as

extent that they are effectively connected with the conduct of a trade or

defined in section 7701(a)(1) of the IRC, and except that references to

business within the United States).

at least eighty percent in section 1504 should be read as more than fifty

percent.

— section 1504 should be read without regard to the exclusion provided

for in section 1504(b)(4).

Department of State Notification

Line 10 — Include total interest expense of the acquirer and all of its

The Business Corporation Law requires that the Department of State be

affiliates for the transaction year.

notified of all mergers or consolidations. The Department of State will notify

the Tax Department of all completed mergers or consolidations. Please

Line 12 — Base your answer on the target’s total capital, before allocation,

refer to Publication 110, Termination of Business Corporation , for specific

as shown on its New York State tax return for the acquisition year. Use a

information and instructions.

quarterly or more frequent average, and exclude ending values; i.e., the

last quarter value is ‘‘0.’’

Definition of Terms

Note: If you answered No on lines 10 and either 11 or 12, complete Part V

A corporate merger is a procedure through which two or more constituent

only. If you answered Yes on lines 10 and either 11 or 12, you must

corporations become a single corporation that is one of the constituent

complete Parts IV, V and VI.

corporations. In a corporate merger, the acquiring person is the constituent

corporation whose stockholders, after the merger, own the largest

Part IV — Ratio Computation

proportion of the total voting power in the surviving corporation, and the

Use this worksheet to compute the combined acquirer and target

target corporations are all other constituent corporations that have been

corporations’ debt-to-equity ratio and the debt-to-assets ratio for both the

absorbed by the acquiring corporation. For purposes of this definition, a

prior and current years, and to compute the percent of change between

corporate merger does not include an excluded transaction.

the current and prior year ratios.

A corporate consolidation is a procedure through which two or more

This worksheet will also determine if the transaction is a highly leveraged

corporations become a single corporation that is a new corporation formed

transaction.

as a result of the consolidation. In a corporate consolidation, acquiring

person means the constituent corporation whose stockholders, after the

The debt-to-equity ratio and the debt-to-asset ratio of an affiliated group

consolidation, own the largest proportion of the total voting power in the

are determined for the entire group. The prior year’s ratio should include

new corporation, and target corporation means all other constituent

the target as well.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2