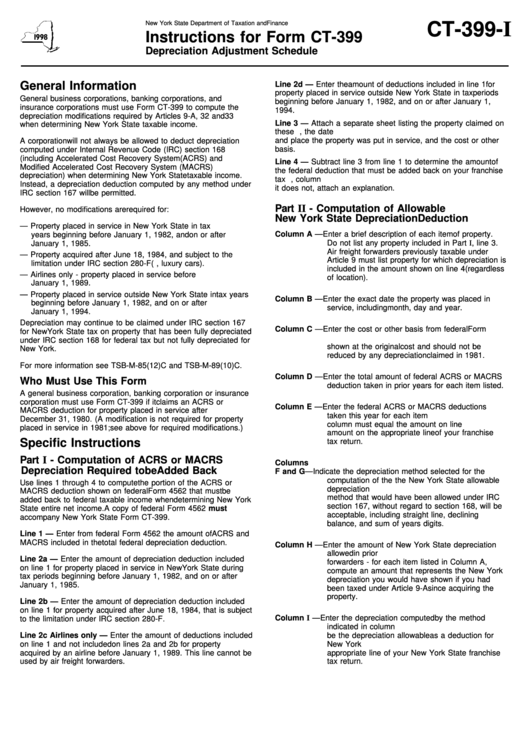

Instructions For Form Ct-399 - Depreciation Adjustment Schedule - New York State Department Of Taxation And Finance - 1998

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-399- I

Instructions for Form CT-399

Depreciation Adjustment Schedule

General Information

Line 2d — Enter the amount of deductions included in line 1 for

property placed in service outside New York State in tax periods

General business corporations, banking corporations, and

beginning before January 1, 1982, and on or after January 1,

insurance corporations must use Form CT-399 to compute the

1994.

depreciation modifications required by Articles 9-A, 32 and 33

Line 3 — Attach a separate sheet listing the property claimed on

when determining New York State taxable income.

these lines. Include a brief description of the property, the date

and place the property was put in service, and the cost or other

A corporation will not always be allowed to deduct depreciation

basis.

computed under Internal Revenue Code (IRC) section 168

(including Accelerated Cost Recovery System (ACRS) and

Line 4 — Subtract line 3 from line 1 to determine the amount of

Modified Accelerated Cost Recovery System (MACRS)

the federal deduction that must be added back on your franchise

depreciation) when determining New York State taxable income.

tax return. This amount must equal the total on line 5, column E. If

Instead, a depreciation deduction computed by any method under

it does not, attach an explanation.

IRC section 167 will be permitted.

Part II - Computation of Allowable

However, no modifications are required for:

New York State Depreciation Deduction

— Property placed in service in New York State in tax

Column A — Enter a brief description of each item of property.

years beginning before January 1, 1982, and on or after

January 1, 1985.

Do not list any property included in Part I, line 3.

Air freight forwarders previously taxable under

— Property acquired after June 18, 1984, and subject to the

Article 9 must list property for which depreciation is

limitation under IRC section 280-F (e.g., luxury cars).

included in the amount shown on line 4 (regardless

— Airlines only - property placed in service before

of location).

January 1, 1989.

— Property placed in service outside New York State in tax years

Column B — Enter the exact date the property was placed in

beginning before January 1, 1982, and on or after

service, including month, day and year.

January 1, 1994.

Depreciation may continue to be claimed under IRC section 167

Column C — Enter the cost or other basis from federal Form

for New York State tax on property that has been fully depreciated

4562. Property placed in service in 1981 must be

under IRC section 168 for federal tax but not fully depreciated for

shown at the original cost and should not be

New York.

reduced by any depreciation claimed in 1981.

For more information see TSB-M-85(12)C and TSB-M-89(10)C.

Column D — Enter the total amount of federal ACRS or MACRS

Who Must Use This Form

deduction taken in prior years for each item listed.

A general business corporation, banking corporation or insurance

corporation must use Form CT-399 if it claims an ACRS or

Column E — Enter the federal ACRS or MACRS deductions

MACRS deduction for property placed in service after

taken this year for each item listed. The total of this

December 31, 1980. (A modification is not required for property

column must equal the amount on line 4. Enter this

placed in service in 1981; see above for required modifications.)

amount on the appropriate line of your franchise

Specific Instructions

tax return.

Part I - Computation of ACRS or MACRS

Columns

Depreciation Required to be Added Back

F and G —

Indicate the depreciation method selected for the

computation of the the New York State allowable

Use lines 1 through 4 to compute the portion of the ACRS or

depreciation deduction. Any consistent depreciation

MACRS deduction shown on federal Form 4562 that must be

method that would have been allowed under IRC

added back to federal taxable income when determining New York

section 167, without regard to section 168, will be

State entire net income. A copy of federal Form 4562 must

acceptable, including straight line, declining

accompany New York State Form CT-399.

balance, and sum of years digits.

Line 1 — Enter from federal Form 4562 the amount of ACRS and

MACRS included in the total federal depreciation deduction.

Column H — Enter the amount of New York State depreciation

allowed in prior years. Exception for air freight

Line 2a — Enter the amount of depreciation deduction included

forwarders - for each item listed in Column A,

on line 1 for property placed in service in New York State during

compute an amount that represents the New York

tax periods beginning before January 1, 1982, and on or after

depreciation you would have shown if you had

January 1, 1985.

been taxed under Article 9-A since acquiring the

property.

Line 2b — Enter the amount of depreciation deduction included

on line 1 for property acquired after June 18, 1984, that is subject

Column I — Enter the depreciation computed by the method

to the limitation under IRC section 280-F.

indicated in column F. The total of this column will

Line 2c Airlines only — Enter the amount of deductions included

be the depreciation allowable as a deduction for

on line 1 and not included on lines 2a and 2b for property

New York State. Enter the total amount on the

acquired by an airline before January 1, 1989. This line cannot be

appropriate line of your New York State franchise

used by air freight forwarders.

tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2