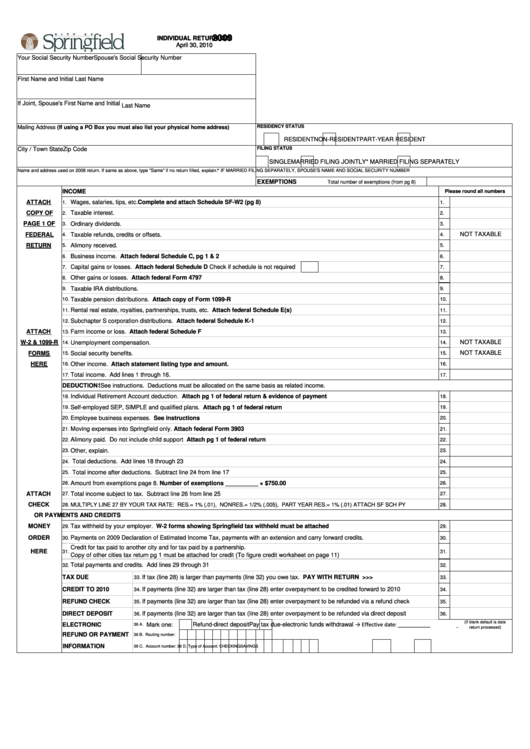

Form Sf - 1040r - Individual Return Due - 2009

ADVERTISEMENT

2009

2009

INDIVIDUAL RETURN DUE

INDIVIDUAL RETURN DUE

April 30, 2010

April 30, 2010

Your Social Security Number

Spouse's Social Security Number

First Name and Initial

Last Name

If Joint, Spouse's First Name and Initial

Last Name

RESIDENCY STATUS

Mailing Address (If using a PO Box you must also list your physical home address)

RESIDENT

NON-RESIDENT

PART-YEAR RESIDENT

FILING STATUS

City / Town

State

Zip Code

SINGLE

MARRIED FILING JOINTLY

* MARRIED FILING SEPARATELY

Name and address used on 2008 return. If same as above, type "Same" if no return filled, explain:

* IF MARRIED FILING SEPARATELY, SPOUSE'S NAME AND SOCIAL SECURITY NUMBER

EXEMPTIONS

Total number of exemptions (from pg 8)

INCOME

Please round all numbers

ATTACH

Complete and attach Schedule SF-W2 (pg 8)

1.

Wages, salaries, tips, etc.

1.

COPY OF

Taxable interest.

2.

2.

PAGE 1 OF

Ordinary dividends.

3.

3.

FEDERAL

Taxable refunds, credits or offsets.

NOT TAXABLE

4.

4.

RETURN

Alimony received.

5.

5.

Business income. Attach federal Schedule C, pg 1 & 2

6.

6.

Capital gains or losses. Attach federal Schedule D

Check if schedule is not required

7.

7.

Other gains or losses. Attach federal Form 4797

8.

8.

9.

Taxable IRA distributions.

9.

Taxable pension distributions. Attach copy of Form 1099-R

10.

10.

Rental real estate, royalties, partnerships, trusts, etc. Attach federal Schedule E(s)

11.

11.

Subchapter S corporation distributions. Attach federal Schedule K-1

12.

12.

ATTACH

Farm income or loss. Attach federal Schedule F

13.

13.

W-2 & 1099-R

NOT TAXABLE

14.

Unemployment compensation.

14.

FORMS

Social security benefits.

NOT TAXABLE

15.

15.

HERE

Other income. Attach statement listing type and amount.

16.

16.

Total income. Add lines 1 through 16.

17.

17.

DEDUCTION See instructions. Deductions must be allocated on the same basis as related income.

S

Individual Retirement Account deduction. Attach pg 1 of federal return & evidence of payment

18.

18.

Self-employed SEP, SIMPLE and qualified plans. Attach pg 1 of federal return

19.

19.

Employee business expenses. See instructions

20.

20.

Moving expenses into Springfield only. Attach federal Form 3903

21.

21.

Alimony paid. Do not include child support Attach pg 1 of federal return

22.

22.

Other, explain.

23.

23.

Total deductions. Add lines 18 through 23

24.

24.

Total income after deductions. Subtract line 24 from line 17

25.

25.

Amount from exemptions page 8. Number of exemptions __________ × $750.00

26.

26.

ATTACH

27.

Total income subject to tax. Subtract line 26 from line 25

27.

CHECK

28.

MULTIPLY LINE 27 BY YOUR TAX RATE: RES.= 1% (.01), NONRES.= 1/2% (.005), PART YEAR RES.= 1% (.01) ATTACH SF SCH PY

28.

PAYMENTS AND CREDITS

OR

MONEY

Tax withheld by your employer. W-2 forms showing Springfield tax withheld must be attached

29.

29.

ORDER

Payments on 2009 Declaration of Estimated Income Tax, payments with an extension and carry forward credits.

30.

30.

Credit for tax paid to another city and for tax paid by a partnership.

HERE

31.

31.

Copy of other cities tax return pg 1 must be attached for credit (To figure credit worksheet on page 11)

Total payments and credits. Add lines 29 through 31

32.

32.

TAX DUE

If tax (line 28) is larger than payments (line 32) you owe tax.

PAY WITH RETURN >>>

33.

33.

CREDIT TO 2010

If payments (line 32) are larger than tax (line 28) enter overpayment to be credited forward to 2010

34.

34.

REFUND CHECK

If payments (line 32) are larger than tax (line 28) enter overpayment to be refunded via a refund check

35.

35.

DIRECT DEPOSIT

If payments (line 32) are larger than tax (line 28) enter overpayment to be refunded via direct deposit

36.

36.

(If blank default is date

ELECTRONIC

Mark one:

Refund-direct deposit

Pay tax due-electronic funds withdrawal → Effective date: ___________

_

36 A.

return processed)

REFUND OR PAYMENT

36 B. Routing number:

INFORMATION

36 C. Account number:

36 D. Type of Account:

CHECKING

SAVINGS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3