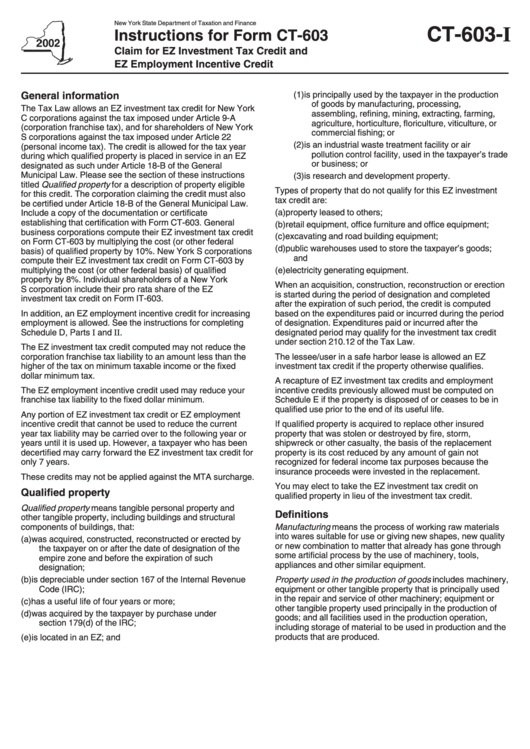

Instructions For Form Ct-603 - Claim For Ez Investment Tax Credit And Ez Employment Incentive Credit - New York State Department Of Taxation And Finance - 2002

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-603-I

Instructions for Form CT-603

Claim for EZ Investment Tax Credit and

EZ Employment Incentive Credit

(1) is principally used by the taxpayer in the production

General information

of goods by manufacturing, processing,

The Tax Law allows an EZ investment tax credit for New York

assembling, refining, mining, extracting, farming,

C corporations against the tax imposed under Article 9-A

agriculture, horticulture, floriculture, viticulture, or

(corporation franchise tax), and for shareholders of New York

commercial fishing; or

S corporations against the tax imposed under Article 22

(2) is an industrial waste treatment facility or air

(personal income tax). The credit is allowed for the tax year

pollution control facility, used in the taxpayer’s trade

during which qualified property is placed in service in an EZ

or business; or

designated as such under Article 18-B of the General

Municipal Law. Please see the section of these instructions

(3) is research and development property.

titled Qualified property for a description of property eligible

Types of property that do not qualify for this EZ investment

for this credit. The corporation claiming the credit must also

tax credit are:

be certified under Article 18-B of the General Municipal Law.

(a) property leased to others;

Include a copy of the documentation or certificate

establishing that certification with Form CT-603. General

(b) retail equipment, office furniture and office equipment;

business corporations compute their EZ investment tax credit

(c) excavating and road building equipment;

on Form CT-603 by multiplying the cost (or other federal

(d) public warehouses used to store the taxpayer’s goods;

basis) of qualified property by 10%. New York S corporations

and

compute their EZ investment tax credit on Form CT-603 by

multiplying the cost (or other federal basis) of qualified

(e) electricity generating equipment.

property by 8%. Individual shareholders of a New York

When an acquisition, construction, reconstruction or erection

S corporation include their pro rata share of the EZ

is started during the period of designation and completed

investment tax credit on Form IT-603.

after the expiration of such period, the credit is computed

In addition, an EZ employment incentive credit for increasing

based on the expenditures paid or incurred during the period

employment is allowed. See the instructions for completing

of designation. Expenditures paid or incurred after the

Schedule D, Parts I and II.

designated period may qualify for the investment tax credit

under section 210.12 of the Tax Law.

The EZ investment tax credit computed may not reduce the

corporation franchise tax liability to an amount less than the

The lessee/user in a safe harbor lease is allowed an EZ

higher of the tax on minimum taxable income or the fixed

investment tax credit if the property otherwise qualifies.

dollar minimum tax.

A recapture of EZ investment tax credits and employment

The EZ employment incentive credit used may reduce your

incentive credits previously allowed must be computed on

franchise tax liability to the fixed dollar minimum.

Schedule E if the property is disposed of or ceases to be in

qualified use prior to the end of its useful life.

Any portion of EZ investment tax credit or EZ employment

incentive credit that cannot be used to reduce the current

If qualified property is acquired to replace other insured

year tax liability may be carried over to the following year or

property that was stolen or destroyed by fire, storm,

years until it is used up. However, a taxpayer who has been

shipwreck or other casualty, the basis of the replacement

decertified may carry forward the EZ investment tax credit for

property is its cost reduced by any amount of gain not

only 7 years.

recognized for federal income tax purposes because the

insurance proceeds were invested in the replacement.

These credits may not be applied against the MTA surcharge.

You may elect to take the EZ investment tax credit on

Qualified property

qualified property in lieu of the investment tax credit.

Qualified property means tangible personal property and

Definitions

other tangible property, including buildings and structural

components of buildings, that:

Manufacturing means the process of working raw materials

into wares suitable for use or giving new shapes, new quality

(a) was acquired, constructed, reconstructed or erected by

or new combination to matter that already has gone through

the taxpayer on or after the date of designation of the

some artificial process by the use of machinery, tools,

empire zone and before the expiration of such

appliances and other similar equipment.

designation;

Property used in the production of goods includes machinery,

(b) is depreciable under section 167 of the Internal Revenue

Code (IRC);

equipment or other tangible property that is principally used

in the repair and service of other machinery; equipment or

(c) has a useful life of four years or more;

other tangible property used principally in the production of

(d) was acquired by the taxpayer by purchase under

goods; and all facilities used in the production operation,

section 179(d) of the IRC;

including storage of material to be used in production and the

products that are produced.

(e) is located in an EZ; and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4