2001 Schedule M1wfc Instructions

ADVERTISEMENT

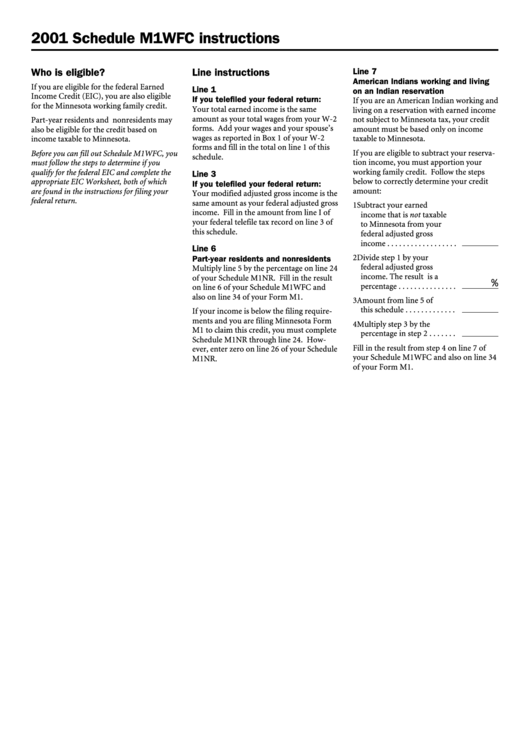

2001 Schedule M1WFC instructions

Line 7

Who is eligible?

Line instructions

American Indians working and living

If you are eligible for the federal Earned

Line 1

on an Indian reservation

Income Credit (EIC), you are also eligible

If you telefiled your federal return:

If you are an American Indian working and

for the Minnesota working family credit.

Your total earned income is the same

living on a reservation with earned income

amount as your total wages from your W-2

not subject to Minnesota tax, your credit

Part-year residents and nonresidents may

forms. Add your wages and your spouse’s

amount must be based only on income

also be eligible for the credit based on

wages as reported in Box 1 of your W-2

income taxable to Minnesota.

taxable to Minnesota.

forms and fill in the total on line 1 of this

If you are eligible to subtract your reserva-

Before you can fill out Schedule M1WFC, you

schedule.

tion income, you must apportion your

must follow the steps to determine if you

working family credit. Follow the steps

qualify for the federal EIC and complete the

Line 3

below to correctly determine your credit

appropriate EIC Worksheet, both of which

If you telefiled your federal return:

amount:

are found in the instructions for filing your

Your modified adjusted gross income is the

federal return.

same amount as your federal adjusted gross

1 Subtract your earned

income. Fill in the amount from line I of

income that is not taxable

your federal telefile tax record on line 3 of

to Minnesota from your

this schedule.

federal adjusted gross

income . . . . . . . . . . . . . . . . . .

Line 6

2 Divide step 1 by your

Part-year residents and nonresidents

federal adjusted gross

Multiply line 5 by the percentage on line 24

income. The result is a

of your Schedule M1NR. Fill in the result

%

percentage . . . . . . . . . . . . . . .

on line 6 of your Schedule M1WFC and

also on line 34 of your Form M1.

3 Amount from line 5 of

this schedule . . . . . . . . . . . . .

If your income is below the filing require-

ments and you are filing Minnesota Form

4 Multiply step 3 by the

M1 to claim this credit, you must complete

percentage in step 2 . . . . . . .

Schedule M1NR through line 24. How-

Fill in the result from step 4 on line 7 of

ever, enter zero on line 26 of your Schedule

your Schedule M1WFC and also on line 34

M1NR.

of your Form M1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1