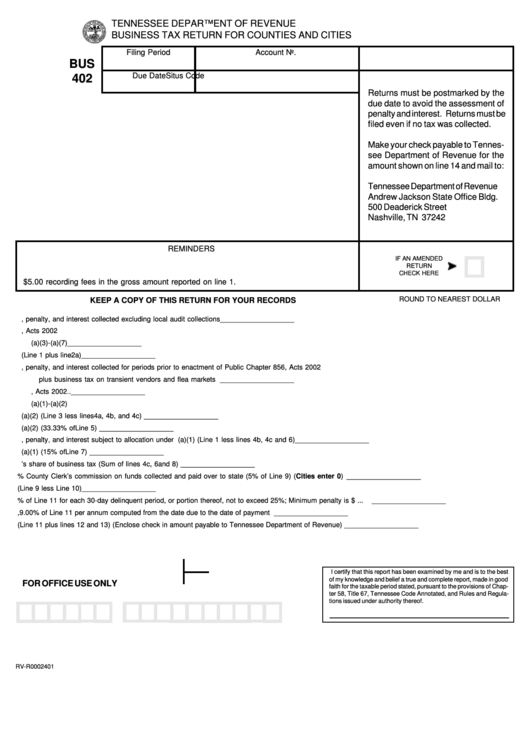

Form Bus 402 - Business Tax Return For Counties And Cities

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

BUSINESS TAX RETURN FOR COUNTIES AND CITIES

Filing Period

Account No.

BUS

Due Date

Situs Code

402

Returns must be postmarked by the

due date to avoid the assessment of

penalty and interest. Returns must be

filed even if no tax was collected.

Make your check payable to Tennes-

see Department of Revenue for the

amount shown on line 14 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

REMINDERS

1.

Annual taxpayers report collections for June 1 through May 31.

IF AN AMENDED

2.

Annual returns are delinquent after June 20th.

RETURN

3.

Monthly and quarterly returns are due the 15th of the month.

CHECK HERE

4.

Do not include your $5.00 recording fees in the gross amount reported on line 1.

ROUND TO NEAREST DOLLAR

KEEP A COPY OF THIS RETURN FOR YOUR RECORDS

1. Total business tax, penalty, and interest collected excluding local audit collections .......................................................................

___________________

2. Credits for payments made to county/city after enactment of Public Chapter 856, Acts 2002

a. Total credits allowed for payments made to county/city under T.C.A. Sec. 67-4-713(a)(3)-(a)(7) ............................................

___________________

3. Total business tax base (Line 1 plus line 2a) .....................................................................................................................................

___________________

4. a. Total business tax, penalty, and interest collected for periods prior to enactment of Public Chapter 856, Acts 2002

plus business tax on transient vendors and flea markets ............................................................................................................

___________________

b. Total penalty and interest collected on local portion of business tax due after enactment of Public Chapter 856, Acts 2002 ..

___________________

c. Total penalty and interest collected on state portion of business tax due under T.C.A. Sec. 67-4-724(a)(1)-(a)(2) .................

___________________

5. Total business tax base subject to allocation under T.C.A. Sec. 67-4-724(a)(2) (Line 3 less lines 4a, 4b, and 4c) ......................

___________________

6. Total collections allocated to state under T.C.A. Sec. 67-4-724(a)(2) (33.33% of Line 5) ..............................................................

___________________

7. Total business tax, penalty, and interest subject to allocation under T.C.A. Sec. 67-4-724(a)(1) (Line 1 less lines 4b, 4c and 6)

___________________

8. Total collections allocated to state under T.C.A. Sec. 67-4-724(a)(1) (15% of Line 7) ...................................................................

___________________

9. Total state’s share of business tax (Sum of lines 4c, 6 and 8) .........................................................................................................

___________________

10. Less 5% County Clerk’s commission on funds collected and paid over to state (5% of Line 9) (Cities enter 0) ........................

___________________

11. Total business tax due to the state (Line 9 less Line 10) ..................................................................................................................

___________________

12. Penalty - 5% of Line 11 for each 30-day delinquent period, or portion thereof, not to exceed 25%; Minimum penalty is $15 .......

___________________

13. Interest - If filed late, 9.00% of Line 11 per annum computed from the date due to the date of payment .......................................

___________________

14. Total remittance (Line 11 plus lines 12 and 13) (Enclose check in amount payable to Tennessee Department of Revenue) ........

___________________

I certify that this report has been examined by me and is to the best

of my knowledge and belief a true and complete report, made in good

FOR OFFICE USE ONLY

faith for the taxable period stated, pursuant to the provisions of Chap-

ter 58, Title 67, Tennessee Code Annotated, and Rules and Regula-

tions issued under authority thereof.

RV-R0002401

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1