Instructions For Form Nc-5500 - Request To Waive Or Reduce Penalties

ADVERTISEMENT

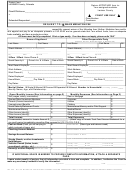

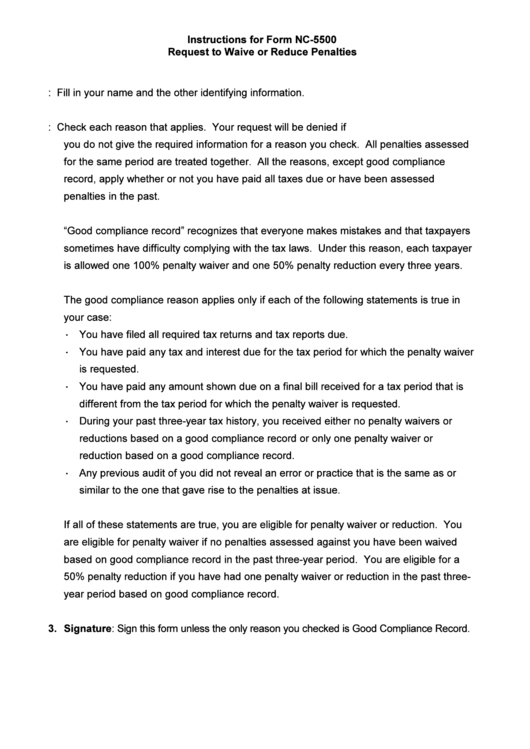

Instructions for Form NC-5500

Request to Waive or Reduce Penalties

1. Identifying Information: Fill in your name and the other identifying information.

2. Reason for Request: Check each reason that applies. Your request will be denied if

you do not give the required information for a reason you check. All penalties assessed

for the same period are treated together. All the reasons, except good compliance

record, apply whether or not you have paid all taxes due or have been assessed

penalties in the past.

“Good compliance record” recognizes that everyone makes mistakes and that taxpayers

sometimes have difficulty complying with the tax laws. Under this reason, each taxpayer

is allowed one 100% penalty waiver and one 50% penalty reduction every three years.

The good compliance reason applies only if each of the following statements is true in

your case:

· You have filed all required tax returns and tax reports due.

· You have paid any tax and interest due for the tax period for which the penalty waiver

is requested.

· You have paid any amount shown due on a final bill received for a tax period that is

different from the tax period for which the penalty waiver is requested.

· During your past three-year tax history, you received either no penalty waivers or

reductions based on a good compliance record or only one penalty waiver or

reduction based on a good compliance record.

· Any previous audit of you did not reveal an error or practice that is the same as or

similar to the one that gave rise to the penalties at issue.

If all of these statements are true, you are eligible for penalty waiver or reduction. You

are eligible for penalty waiver if no penalties assessed against you have been waived

based on good compliance record in the past three-year period. You are eligible for a

50% penalty reduction if you have had one penalty waiver or reduction in the past three-

year period based on good compliance record.

3. Signature: Sign this form unless the only reason you checked is Good Compliance Record.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1