Publication 556 (Rev. August 2005) - Examination Of Returns, Appeal Rights,and Claims For Refund Page 13

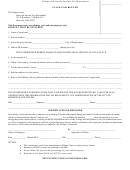

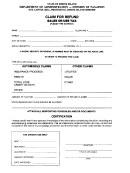

ADVERTISEMENT

See Publication 3920 for information on filing

A list of the areas eligible for assistance under the

TIP

TIP

claims for tax forgiveness for individuals affected

Disaster Relief and Emergency Assistance Act is

by terrorist attacks.

available at the Federal Emergency Management

Agency (FEMA) website at and at the IRS

website at

Requesting a copy of your tax return. You can obtain a

copy of the actual return and all attachments you filed with

Nonfilers can get refund of overpayments paid within

the IRS for an earlier year. This includes a copy of the

Form W-2 or Form 1099 filed with your return. Use Form

3-year period. The Tax Court can consider taxes paid

during the 3-year period preceding the date of a notice of

4506 to make your request. You will be charged a fee,

deficiency for determining any refund due to a nonfiler.

which you must pay when you submit Form 4506.

This means that if you do not file your return, and you

Requesting a copy of your tax account information.

receive a notice of deficiency in the third year after the due

Use Form 4506-T, Request for Transcript of Tax Return, to

date (with extensions) of your return and file suit with the

request free copies of your tax return transcript, tax ac-

Tax Court to contest the notice of deficiency, you may be

count transcript, record of account, verification of nonfiling,

able to receive a refund of excessive amounts paid within

or Form W-2, Form 1099 series, Form 1098 series, or

the 3-year period preceding the date of the notice of defi-

Form 5498 series transcript. The tax return transcript con-

ciency.

tains most of the line items of a tax return. A tax account

The IRS may postpone for up to 1 year certain tax

transcript contains information on the financial status of the

TIP

deadlines, including the time for filing claims for

account, such as payments, penalty assessments, and

refund, for taxpayers who are affected by a terror-

adjustments. A record of account is a combination of line

ist attack occurring after September 10, 2001. For more

item information and later adjustments to the account.

information, see Publication 3920.

Form W-2, Form 1099 series, Form 1098 series, or Form

5498 series transcript contains data from these information

Claim for refund by estates electing the installment

returns.

method of payment. In certain cases where an estate

has elected to make tax payments through the installment

Time for Filing a Claim for Refund

method, the executor can file a suit for refund with a

Federal District Court or the U.S. Court of Federal Claims

Generally, you must file a claim for a credit or refund within

before all the installment payments have been made. How-

3 years from the date you filed your original return or 2

ever, all the following must be true before a suit can be

years from the date you paid the tax, whichever is later. If

filed.

you do not file a claim within this period, you may no longer

•

be entitled to a credit or a refund.

The estate consists largely of an interest in a

If the due date to file a return or a claim for a credit or

closely-held business.

refund is a Saturday, Sunday, or legal holiday, it is filed on

•

All installment payments due on or before the date

time if it is filed on the next business day. Returns you filed

the suit is filed have been made.

before the due date are considered filed on the due date.

•

This is true even when the due date is a Saturday, Sunday,

No accelerated installment payments have been

or legal holiday.

made.

•

Disaster area claims for refund. If you live in a Presiden-

No Tax Court case is pending with respect to any

tially declared disaster area or are affected by terroristic or

estate tax liability.

military action, the deadline to file a claim for a refund may

•

If a notice of deficiency was issued to the estate

be postponed. This section discusses the special rules that

regarding its liability for estate tax, the time for peti-

apply to Presidentially declared disaster area refunds.

tioning the Tax Court has passed.

A Presidentially declared disaster is a disaster that

•

occurred in an area declared by the President to be eligible

No proceeding is pending for a declaratory judgment

for federal assistance under the Disaster Relief and Emer-

by the Tax Court on whether the estate is eligible to

gency Assistance Act.

pay tax in installments.

•

Postponed refund deadlines. The IRS may postpone

The executor has not included any previously liti-

for up to 1 year the deadlines for filing a claim for refund.

gated issues in the current suit for refund.

The postponement can be used by taxpayers who are

•

The executor does not discontinue making install-

affected by a presidentially declared disaster. The IRS may

ment payments timely, while the court considers the

also postpone deadlines for filing income and employment

suit for refund.

tax returns, paying income and employment taxes, and

making contributions to a traditional IRA or Roth IRA. For

If in its final decision on the suit for refund the

more information, see Publication 547.

TIP

If any deadline is postponed, the IRS will publicize the

court redetermines the estate’s tax liability, the

postponement in your area and publish a news release,

IRS must refund any part of the estate tax amount

that is disallowed. This includes any part of the disallowed

revenue ruling, revenue procedure, notice, announce-

ment, or other guidance in the Internal Revenue Bulletin.

amount previously collected by the IRS.

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19