Tax Preparer'S Guide For Income Tax Returns - 2015 Page 11

ADVERTISEMENT

For questions about the tax preparer requirement, go to the TRD website, click Tax

Professionals, and then click E-filing Mandates.

Tax Preparers’ Signature Requirements

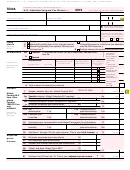

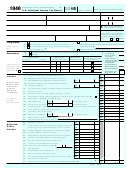

On PIT-1, page 2 is the Paid preparers use only section. Paid tax preparers

must fill out this section and sign the tax returns they prepare. The preparer

may sign by hand or any other method of electronic signature acceptable to the

IRS. Tax preparers who do not charge for preparing tax returns do not need to sign

the return.

Paid preparers must enter their 11-digit New Mexico CRS identification number*,

FEIN (if applicable), and an IRS-issued PTIN. A penalty is imposed for failure to

comply, as described in the next section.

*A paid preparer who is not required to have a New Mexico CRS identification

number is not required to complete this field. Generally, persons are not required to

obtain a CRS identification number unless they perform services in New Mexico,

have an employee or a business location in New Mexico, sell property in New

Mexico, or lease property employed in New Mexico.

Tax Preparer Detection and Disclosure of

Suspicious Activity

Guidelines for Reporting Tax Fraud

Your tips are important. By helping us crack down on tax fraud, you help make sure

that everyone in New Mexico pays a fair share of taxes. Those taxes, as you know,

are used to pay for the public services our state provides.

How to Report Tax Fraud

There are three ways to report tax fraud.

1. Call the 24-Hour New Mexico Tax Fraud Hot Line: 1-866-457-6789.

2. Send an Email: Tax.Fraud@state.nm.us

3. Download the Fraud Information Report Complete the form and mail or fax it

to:

New Mexico Taxation and Revenue Department

Tax Fraud Investigations Division

P.O. Box 8487

Albuquerque, NM 87198

Fax Number: (505) 841-5581

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45