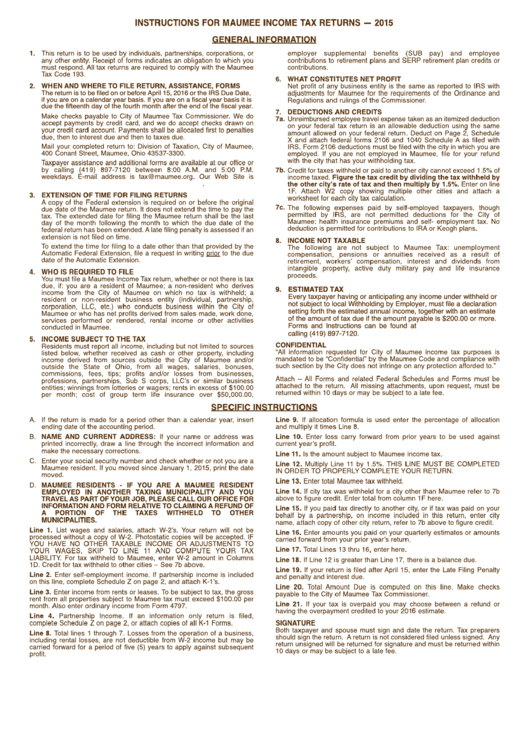

Instructions For Income Tax Returns - Maumee 2015

ADVERTISEMENT

5

The return is to be filed on or before April 15, 2016 or the IRS Due Date,

if you are on a calendar year basis. If you are on a fiscal year basis it is

due the fifteenth day of the fourth month after the end of the fiscal year.

.

9.

ESTIMATED TAX

Every taxpayer having or anticipating any income under withheld or

not subject to local Withholding by Employer, must file a declaration

setting forth the estimated annual income, together with an estimate

of the amount of tax due if the amount payable is $200.00 or more.

Forms and Instructions can be found at or by

calling (419) 897-7120.

5

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1