Instructions For Pa-41 Schedule J - Income From Estates Or Trusts - Pennsylvania Department Of Revenue - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule J

Income from Estates or Trusts

Column PA-41 Schedule

LINE 2

GENERAL INFORMATION

RK-1/NRK-1

Check the box if the estate or trust in-

Total Estate or Trust Income

PURPOSE OF SCHEDULE

come you are reporting is from a PA-41

Add all amounts listed on Line 1.

Use PA-41 Schedule J to report the

Schedule RK-1 or NRK-1.

total income received of an estate or

LINE 3

trust or that the estate or trust credited

IMPORTANT: Do not check this

to you as reported on PA-41 Schedule

box if you use a federal Form

Estate or Trust Income from

RK-1 and/or NRK-1. For Pennsylvania

1041 Schedule K-1 to report income.

Partnerships

income tax purposes, an estate or trust

If the estate or trust received estate or

cannot distribute a loss.

Column (b)

trust income from a partnership, enter

Federal EIN

If a PA S corporation, partnership or

the income from the PA-41 Schedule

Enter the estate or trust federal em-

entity formed as a limited liability com-

RK-1, Line 6 in Column c and the in-

ployer identification number (FEIN).

pany that is classified as a partnership

come from the PA-41 Schedule NRK-1,

or PA S corporation for federal income

Column (c)

Line 4 in Column c.

tax purposes receives a PA-41 Sched-

Income Amount

ule RK-1 or NRK-1 that reports income

LINE 4

For a resident estate or trust, enter the

from an estate or trust, the entity must

amount from PA-41 Schedule RK-1,

complete PA-41 Schedule J using the

Estate or Trust Income from

Line 6 or enter the total of all positive in-

information provided from the RK-

PA S Corporations

come amounts when only a federal

1/NRK-1 and distribute the income to

If the estate or trust received estate or

Form 1041 Schedule K-1 is received in-

the partners or shareholders as appli-

trust income from an S corporation,

stead of the PA-41 Schedule RK-1.

cable.

enter the income from PA-41 Schedule

RK-1, Line 6 in Column c and the in-

For a nonresident estate or trust, enter

FORM INSTRUCTIONS

come from PA-41 Schedule NRK-1,

the amount from PA Schedule NRK-1,

Line 4 in Column c.

Line 4 or only the Pennsylvania-source

Name

income from a federal Form 1041

Enter the complete name of the estate

LINE 5

or trust as shown on the PA-41, Fiduci-

Schedule K-1.

ary Income Tax Return.

Total Estate or Trust Income

TIP: Grantor or taxable trusts do

FEIN

not distribute losses as trust in-

Column (c)

Enter the nine-digit federal employer

come. Therefore, all amounts reported

Total Column (c) and enter the amount

identification number (FEIN) of the es-

on PA-41 Schedule J must be positive.

on the PA-41, Fiduciary Income Tax Re-

tate or trust as shown on the PA-41, Fi-

turn, Line 6.

duciary Income Tax Return.

LINE INSTRUCTIONS

CAUTION. The federal amount

Column (a)

may not be corrected for Penn-

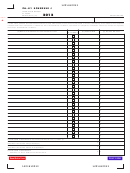

Name and Address of each

sylvania purposes. Contact the fiduciary

Estate or Trust

LINE 1

of the estate or trust to verify the correct

Enter the complete name and address

Pennsylvania income.

Enter the name and address of each

of each estate or trust that received a

PA-41 Schedule RK-1 or NRK-1.

estate or trust.

PA-41 Schedule J

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1