2005 Maine Minimum Tax Worksheet

ADVERTISEMENT

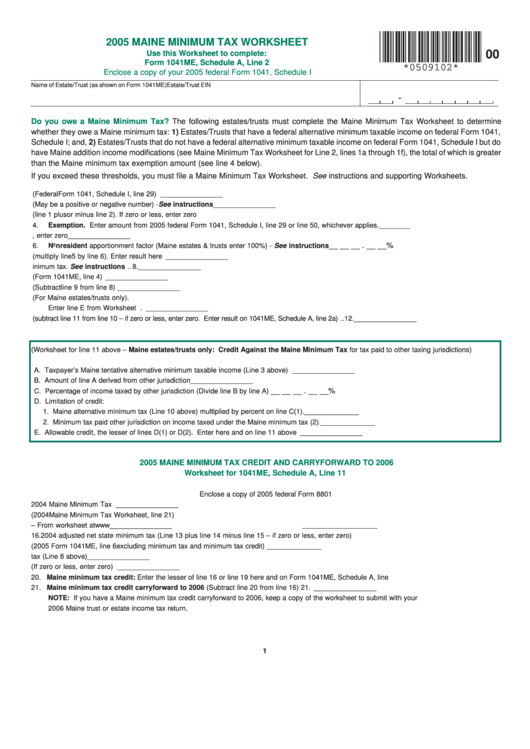

2005 MAINE MINIMUM TAX WORKSHEET

00

Use this Worksheet to complete:

Form 1041ME, Schedule A, Line 2

*0509102*

Enclose a copy of your 2005 federal Form 1041, Schedule I

Name of Estate/Trust (as shown on Form 1041ME)

Estate/Trust EIN

-

Do you owe a Maine Minimum Tax?

The following estates/trusts must complete the Maine Minimum Tax Worksheet to determine

whether they owe a Maine minimum tax: 1) Estates/Trusts that have a federal alternative minimum taxable income on federal Form 1041,

Schedule I; and, 2) Estates/Trusts that do not have a federal alternative minimum taxable income on federal Form 1041, Schedule I but do

have Maine addition income modifications (see Maine Minimum Tax Worksheet for Line 2, lines 1a through 1f), the total of which is greater

than the Maine minimum tax exemption amount (see line 4 below).

If you exceed these thresholds, you must file a Maine Minimum Tax Worksheet. See instructions and supporting Worksheets.

1.

Federal alternative minimum taxable income (Federal Form 1041, Schedule I, line 29) ......................................................... 1. ________________

2.

Modifications (May be a positive or negative number) - See instructions .............................................................................. 2. ________________

3.

Maine tentative alternative minimum taxable income (line 1 plus or minus line 2). If zero or less, enter zero ........................ 3. ________________

4.

Exemption. Enter amount from 2005 federal Form 1041, Schedule I, line 29 or line 50, whichever applies. ....................... 4. ________________

5.

Line 3 plus or minus line 4. If zero or less, enter zero ............................................................................................................... 5. ________________

__ __ __ . __ __%

6.

Nonresident apportionment factor (Maine estates & trusts enter 100%) - See instructions ................................................. 6.

7.

Maine alternative minimum taxable income (multiply line 5 by line 6). Enter result here ......................................................... 7. ________________

8.

Tentative minimum tax. See instructions ................................................................................................................................. 8. ________________

9.

Maine income tax (Form 1041ME, line 4) .................................................................................................................................. 9. ________________

10. Alternative minimum tax (Subtract line 9 from line 8) .............................................................................................................. 10. ________________

11. Credit against the Maine minimum tax for minimum tax paid to other jurisdictions (For Maine estates/trusts only).

Enter line E from Worksheet below. ........................................................................................................................................ 11. ________________

12. Maine Minimum Tax (subtract line 11 from line 10 – if zero or less, enter zero. Enter result on 1041ME, Schedule A, line 2a) .. 12. ________________

(Worksheet for line 11 above – Maine estates/trusts only: Credit Against the Maine Minimum Tax for tax paid to other taxing jurisdictions)

A. Taxpayer’s Maine tentative alternative minimum taxable income (Line 3 above) ..................................................................... A. ________________

B. Amount of line A derived from other jurisdiction ......................................................................................................................... B. ________________

__ __ __ . __ __%

C. Percentage of income taxed by other jurisdiction (Divide line B by line A) ............................................................................... C.

D. Limitation of credit:

1. Maine alternative minimum tax (Line 10 above) multiplied by percent on line C ........................ D(1). ______________

2. Minimum tax paid other jurisdiction on income taxed under the Maine minimum tax ................. D(2). ______________

E. Allowable credit, the lesser of lines D(1) or D(2). Enter here and on line 11 above ................................................................. E. ________________

2005 MAINE MINIMUM TAX CREDIT AND CARRYFORWARD TO 2006

Worksheet for 1041ME, Schedule A, Line 11

Enclose a copy of 2005 federal Form 8801

13. Enter the amount from line 12 of the 2004 Maine Minimum Tax Worksheet .......................................................................... 13. ________________

14. Minimum tax credit carryforward from 2004 (2004 Maine Minimum Tax Worksheet, line 21) ................................................ 14. ________________

15. Enter 2004 net state minimum tax on federal exclusion items – From worksheet at .................... 15. ________________

16. 2004 adjusted net state minimum tax (Line 13 plus line 14 minus line 15 – if zero or less, enter zero) ................................ 16. ________________

17. Enter 2005 Maine income tax liability (2005 Form 1041ME, line 6 excluding minimum tax and minimum tax credit) .......... 17. ________________

18. Enter 2005 Maine tentative minimum tax (Line 8 above) ........................................................................................................ 18. ________________

19. Subtract line 18 from line 17 (If zero or less, enter zero) ........................................................................................................ 19. ________________

20. Maine minimum tax credit: Enter the lesser of line 16 or line 19 here and on Form 1041ME, Schedule A, line 11 ........... 20. ________________

21. Maine minimum tax credit carryforward to 2006 (Subtract line 20 from line 16) ............................................................... 21. ________________

NOTE: If you have a Maine minimum tax credit carryforward to 2006, keep a copy of the worksheet to submit with your

2006 Maine trust or estate income tax return.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2