Form Rpu-3 Instructions - Department Of Revenue

ADVERTISEMENT

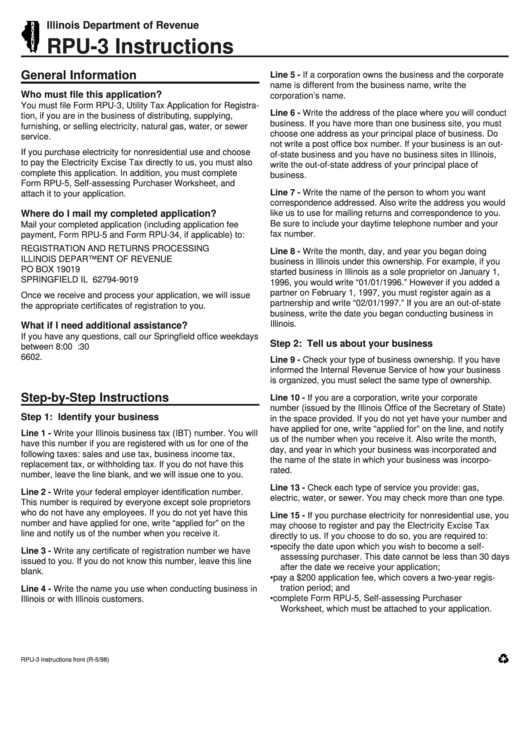

Illinois Department of Revenue

RPU-3 Instructions

General Information

Line 5 - If a corporation owns the business and the corporate

name is different from the business name, write the

Who must file this application?

corporation’s name.

You must file Form RPU-3, Utility Tax Application for Registra-

Line 6 - Write the address of the place where you will conduct

tion, if you are in the business of distributing, supplying,

business. If you have more than one business site, you must

furnishing, or selling electricity, natural gas, water, or sewer

choose one address as your principal place of business. Do

service.

not write a post office box number. If your business is an out-

If you purchase electricity for nonresidential use and choose

of-state business and you have no business sites in Illinois,

to pay the Electricity Excise Tax directly to us, you must also

write the out-of-state address of your principal place of

complete this application. In addition, you must complete

business.

Form RPU-5, Self-assessing Purchaser Worksheet, and

Line 7 - Write the name of the person to whom you want

attach it to your application.

correspondence addressed. Also write the address you would

Where do I mail my completed application?

like us to use for mailing returns and correspondence to you.

Be sure to include your daytime telephone number and your

Mail your completed application (including application fee

fax number.

payment, Form RPU-5 and Form RPU-34, if applicable) to:

REGISTRATION AND RETURNS PROCESSING

Line 8 - Write the month, day, and year you began doing

ILLINOIS DEPARTMENT OF REVENUE

business in Illinois under this ownership. For example, if you

PO BOX 19019

started business in Illinois as a sole proprietor on January 1,

SPRINGFIELD IL 62794-9019

1996, you would write “01/01/1996.” However if you added a

partner on February 1, 1997, you must register again as a

Once we receive and process your application, we will issue

partnership and write “02/01/1997.” If you are an out-of-state

the appropriate certificates of registration to you.

business, write the date you began conducting business in

Illinois.

What if I need additional assistance?

If you have any questions, call our Springfield office weekdays

Step 2: Tell us about your business

between 8:00 a.m. and 4:30 p.m. at 217 524-5406 or 217 785-

6602.

Line 9 - Check your type of business ownership. If you have

informed the Internal Revenue Service of how your business

is organized, you must select the same type of ownership.

Step-by-Step Instructions

Line 10 - If you are a corporation, write your corporate

number (issued by the Illinois Office of the Secretary of State)

Step 1: Identify your business

in the space provided. If you do not yet have your number and

have applied for one, write “applied for” on the line, and notify

Line 1 - Write your Illinois business tax (IBT) number. You will

us of the number when you receive it. Also write the month,

have this number if you are registered with us for one of the

day, and year in which your business was incorporated and

following taxes: sales and use tax, business income tax,

the name of the state in which your business was incorpo-

replacement tax, or withholding tax. If you do not have this

rated.

number, leave the line blank, and we will issue one to you.

Line 13 - Check each type of service you provide: gas,

Line 2 - Write your federal employer identification number.

electric, water, or sewer. You may check more than one type.

This number is required by everyone except sole proprietors

who do not have any employees. If you do not yet have this

Line 15 - If you purchase electricity for nonresidential use, you

number and have applied for one, write “applied for” on the

may choose to register and pay the Electricity Excise Tax

line and notify us of the number when you receive it.

directly to us. If you choose to do so, you are required to:

• specify the date upon which you wish to become a self-

Line 3 - Write any certificate of registration number we have

assessing purchaser. This date cannot be less than 30 days

issued to you. If you do not know this number, leave this line

after the date we receive your application;

blank.

• pay a $200 application fee, which covers a two-year regis-

tration period; and

Line 4 - Write the name you use when conducting business in

• complete Form RPU-5, Self-assessing Purchaser

Illinois or with Illinois customers.

Worksheet, which must be attached to your application.

RPU-3 Instructions front (R-5/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2