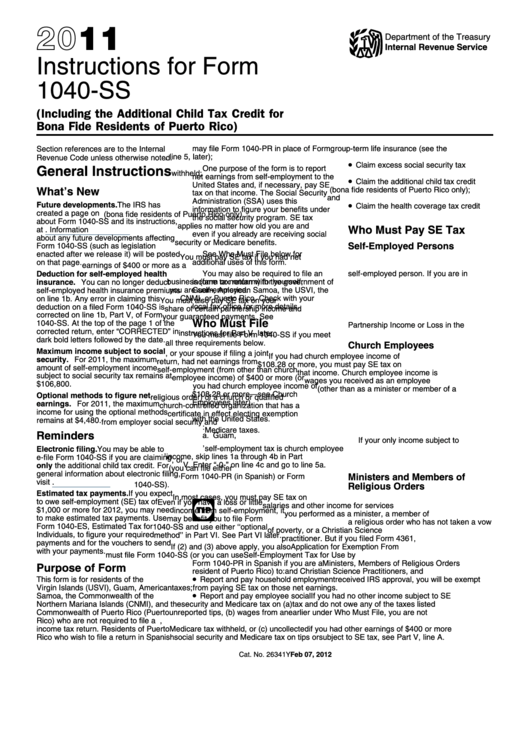

Instructions For Form 1040-Ss - U.s. Self-Employment Tax Return (Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico) - Internal Revenue Service - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form

1040-SS

U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for

Bona Fide Residents of Puerto Rico)

Section references are to the Internal

may file Form 1040-PR in place of Form

group-term life insurance (see the

1040-SS.

instructions for Part I, line 5, later);

Revenue Code unless otherwise noted.

•

Claim excess social security tax

General Instructions

One purpose of the form is to report

withheld;

net earnings from self-employment to the

•

Claim the additional child tax credit

United States and, if necessary, pay SE

What’s New

(bona fide residents of Puerto Rico only);

tax on that income. The Social Security

and

Administration (SSA) uses this

•

Future developments. The IRS has

Claim the health coverage tax credit

information to figure your benefits under

created a page on IRS.gov for information

(bona fide residents of Puerto Rico only).

the social security program. SE tax

about Form 1040-SS and its instructions,

applies no matter how old you are and

Who Must Pay SE Tax

at Information

even if you already are receiving social

about any future developments affecting

security or Medicare benefits.

Self-Employed Persons

Form 1040-SS (such as legislation

See Who Must File below for

enacted after we release it) will be posted

You must pay SE tax if you had net

additional uses of this form.

on that page.

earnings of $400 or more as a

Deduction for self-employed health

You may also be required to file an

self-employed person. If you are in

insurance. You can no longer deduct

income tax return with the government of

business (farm or nonfarm) for yourself,

self-employed health insurance premiums

Guam, American Samoa, the USVI, the

you are self-employed.

CNMI, or Puerto Rico. Check with your

on line 1b. Any error in claiming this

You must also pay SE tax on your

local tax office for more details.

deduction on a filed Form 1040-SS is

share of certain partnership income and

corrected on line 1b, Part V, of Form

your guaranteed payments. See

Who Must File

1040-SS. At the top of the page 1 of the

Partnership Income or Loss in the

corrected return, enter “CORRECTED” in

instructions for Part V, later.

You must file Form 1040-SS if you meet

dark bold letters followed by the date.

all three requirements below.

Church Employees

Maximum income subject to social

1. You, or your spouse if filing a joint

If you had church employee income of

security. For 2011, the maximum

return, had net earnings from

$108.28 or more, you must pay SE tax on

amount of self-employment income

self-employment (from other than church

that income. Church employee income is

subject to social security tax remains at

employee income) of $400 or more (or

wages you received as an employee

$106,800.

you had church employee income of

(other than as a minister or member of a

$108.28 or more — see Church

Optional methods to figure net

religious order) of a church or qualified

Employees later).

earnings. For 2011, the maximum

church-controlled organization that has a

2. You do not have to file Form 1040

income for using the optional methods

certificate in effect electing exemption

with the United States.

remains at $4,480.

from employer social security and

3. You are a resident of:

Medicare taxes.

Reminders

a. Guam,

If your only income subject to

b. American Samoa,

self-employment tax is church employee

Electronic filing. You may be able to

c. The USVI,

income, skip lines 1a through 4b in Part

e-file Form 1040-SS if you are claiming

d. The CNMI, or

V. Enter “-0-” on line 4c and go to line 5a.

only the additional child tax credit. For

e. Puerto Rico (you can file either

general information about electronic filing,

Ministers and Members of

Form 1040-PR (in Spanish) or Form

visit

1040-SS).

Religious Orders

Estimated tax payments. If you expect

In most cases, you must pay SE tax on

to owe self-employment (SE) tax of

Even if you have a loss or little

salaries and other income for services

$1,000 or more for 2012, you may need

income from self-employment, it

TIP

you performed as a minister, a member of

to make estimated tax payments. Use

may benefit you to file Form

a religious order who has not taken a vow

Form 1040-ES, Estimated Tax for

1040-SS and use either ‘‘optional

of poverty, or a Christian Science

Individuals, to figure your required

method’’ in Part VI. See Part VI later.

practitioner. But if you filed Form 4361,

payments and for the vouchers to send

If (2) and (3) above apply, you also

Application for Exemption From

with your payments.

must file Form 1040-SS (or you can use

Self-Employment Tax for Use by

Form 1040-PR in Spanish if you are a

Ministers, Members of Religious Orders

Purpose of Form

resident of Puerto Rico) to:

and Christian Science Practitioners, and

•

This form is for residents of the U.S.

Report and pay household employment

received IRS approval, you will be exempt

Virgin Islands (USVI), Guam, American

taxes;

from paying SE tax on those net earnings.

•

Samoa, the Commonwealth of the

Report and pay employee social

If you had no other income subject to SE

Northern Mariana Islands (CNMI), and the

security and Medicare tax on (a)

tax and do not owe any of the taxes listed

Commonwealth of Puerto Rico (Puerto

unreported tips, (b) wages from an

earlier under Who Must File, you are not

Rico) who are not required to file a U.S.

employer with no social security or

required to file Form 1040-SS. However,

income tax return. Residents of Puerto

Medicare tax withheld, or (c) uncollected

if you had other earnings of $400 or more

Rico who wish to file a return in Spanish

social security and Medicare tax on tips or

subject to SE tax, see Part V, line A.

Feb 07, 2012

Cat. No. 26341Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10