Instructions For Form Wr - Oregon Annual Withholding Tax Reconciliation Report - Oregon Department Of Revenue

ADVERTISEMENT

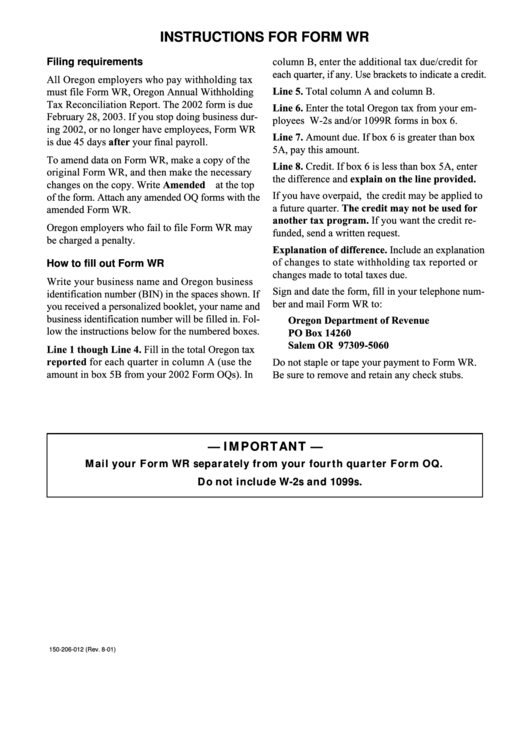

INSTRUCTIONS FOR FORM WR

Filing requirements

column B, enter the additional tax due/credit for

each quarter, if any. Use brackets to indicate a credit.

All Oregon employers who pay withholding tax

Line 5. Total column A and column B.

must file Form WR, Oregon Annual Withholding

Tax Reconciliation Report. The 2002 form is due

Line 6. Enter the total Oregon tax from your em-

February 28, 2003. If you stop doing business dur-

ployees W-2s and/or 1099R forms in box 6.

ing 2002, or no longer have employees, Form WR

Line 7. Amount due. If box 6 is greater than box

is due 45 days after your final payroll.

5A, pay this amount.

To amend data on Form WR, make a copy of the

Line 8. Credit. If box 6 is less than box 5A, enter

original Form WR, and then make the necessary

the difference and explain on the line provided.

changes on the copy. Write Amended at the top

If you have overpaid, the credit may be applied to

of the form. Attach any amended OQ forms with the

a future quarter. The credit may not be used for

amended Form WR.

another tax program. If you want the credit re-

Oregon employers who fail to file Form WR may

funded, send a written request.

be charged a penalty.

Explanation of difference. Include an explanation

of changes to state withholding tax reported or

How to fill out Form WR

changes made to total taxes due.

Write your business name and Oregon business

Sign and date the form, fill in your telephone num-

identification number (BIN) in the spaces shown. If

ber and mail Form WR to:

you received a personalized booklet, your name and

business identification number will be filled in. Fol-

Oregon Department of Revenue

low the instructions below for the numbered boxes.

PO Box 14260

Salem OR 97309-5060

Line 1 though Line 4. Fill in the total Oregon tax

reported for each quarter in column A (use the

Do not staple or tape your payment to Form WR.

amount in box 5B from your 2002 Form OQs). In

Be sure to remove and retain any check stubs.

— IMPORTANT —

Mail your Form WR separately from your fourth quarter Form OQ.

Do not include W-2s and 1099s.

150-206-012 (Rev. 8-01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1