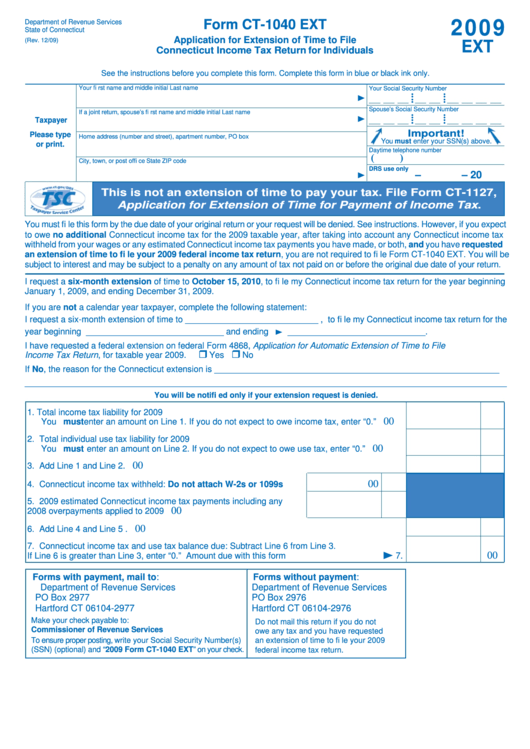

Form Ct-1040 Ext - Application For Extension Of Time To File Connecticut Income Tax Return For Individuals - 2009

ADVERTISEMENT

Department of Revenue Services

2009

Form CT-1040 EXT

State of Connecticut

Application for Extension of Time to File

(Rev. 12/09)

EXT

Connecticut Income Tax Return for Individuals

See the instructions before you complete this form. Complete this form in blue or black ink only.

Your fi rst name and middle initial

Last name

Your Social Security Number

• •

• •

• •

• •

Spouse’s Social Security Number

If a joint return, spouse’s fi rst name and middle initial

Last name

• •

• •

Taxpayer

• •

• •

Important!

Please type

Home address (number and street), apartment number, PO box

You must enter your SSN(s) above.

or print.

Daytime telephone number

(

)

City, town, or post offi ce

State

ZIP code

DRS use only

–

– 20

This is not an extension of time to pay your tax. File Form CT-1127,

Application for Extension of Time for Payment of Income Tax.

You must fi le this form by the due date of your original return or your request will be denied. See instructions. However, if you expect

to owe no additional Connecticut income tax for the 2009 taxable year, after taking into account any Connecticut income tax

withheld from your wages or any estimated Connecticut income tax payments you have made, or both, and you have requested

an extension of time to fi le your 2009 federal income tax return, you are not required to fi le Form CT-1040 EXT. You will be

subject to interest and may be subject to a penalty on any amount of tax not paid on or before the original due date of your return.

I request a six-month extension of time to October 15, 2010, to fi le my Connecticut income tax return for the year beginning

January 1, 2009, and ending December 31, 2009.

If you are not a calendar year taxpayer, complete the following statement:

I request a six-month extension of time to ____________________________ , to fi le my Connecticut income tax return for the

year beginning _____________________________ and ending

_____________________________ .

I have requested a federal extension on federal Form 4868, Application for Automatic Extension of Time to File U.S. Individual

Income Tax Return, for taxable year 2009.

Yes

No

If No, the reason for the Connecticut extension is ____________________________________________________________

______________________________________________________________________________________________________________

You will be notifi ed only if your extension request is denied.

1. Total income tax liability for 2009

00

You must enter an amount on Line 1. If you do not expect to owe income tax, enter “0.” ........1.

2. Total individual use tax liability for 2009

00

You must enter an amount on Line 2. If you do not expect to owe use tax, enter “0.” ..............2.

00

3. Add Line 1 and Line 2. ...............................................................................................................3.

00

4. Connecticut income tax withheld: Do not attach W-2s or 1099s ....4.

5. 2009 estimated Connecticut income tax payments including any

00

2008 overpayments applied to 2009 ................................................5.

00

6. Add Line 4 and Line 5 . ..............................................................................................................6.

7. Connecticut income tax and use tax balance due: Subtract Line 6 from Line 3.

If Line 6 is greater than Line 3, enter “0.” Amount due with this form ................................

00

7.

Forms with payment, mail to:

Forms without payment:

Department of Revenue Services

Department of Revenue Services

PO Box 2977

PO Box 2976

Hartford CT 06104-2977

Hartford CT 06104-2976

Make your check payable to:

Do not mail this return if you do not

Commissioner of Revenue Services

owe any tax and you have requested

To ensure proper posting, write your Social Security Number(s)

an extension of time to fi le your 2009

(SSN) (optional) and “2009 Form CT-1040 EXT” on your check.

federal income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1