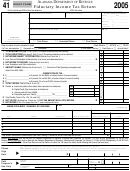

.00

25

Fill in net tax from line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

.00

26

Sales and use tax due on out-of-state purchases (see page 11) . . . . . . . . . . . . . . . . . . . . . . . . . 26

.00

27

Endangered resources donation (decreases refund or increases amount owed) . . . . .

27

.00

28

Packers football stadium donation (decreases refund or increases amount owed) . . . . . .

28

.00

29

Breast cancer research donation (decreases refund or increases amount owed) . . . . . . . .

29

.00

30

Veterans trust fund donation (decreases refund or increases amount owed) . . . . . .

30

.00

31

Add lines 25 through 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

.00

32

Wisconsin income tax withheld. Enclose withholding statements . . . 32

.00

33

2005 estimated tax payments and amount applied from 2004 return . 33

34

Earned income credit (see page 12)

Qualifying

Federal

.00

.00

children

credit . .

x

% = . . 34

.00

35

Homestead credit. Attach Schedule H or H-EZ . . . . . . . . . . . . . . . . . . 35

.00

36

Eligible veterans and surviving spouses property tax credit . . . . . . . . 36

.00

37

Add lines 32 through 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

.00

38

If line 37 is more than line 31, subtract line 31 from line 37. This is the AMOUNT YOU OVERPAID 38

.00

39

Amount of line 38 you want REFUNDED TO YOU . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

.00

40

Amount of line 38 you want applied to your 2006 estimated tax . . . 40

.00

41

If line 37 is less than line 31, subtract line 37 from line 31. This is the AMOUNT YOU OWE . . 41

.00

42

Underpayment interest. Also include on line 41 . . . . . . . . . . . . . . . . 42

Sign below

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Your signature

Spouse’s signature (if filing jointly, BOTH must sign)

Date

Mail your return to:

Wisconsin Department of Revenue

For Department Use Only

If tax due ................................... PO Box 268, Madison WI 53790-0001

R

M

Y

T

MAN

D

A

P

C

If homestead credit claimed .... PO Box 34, Madison WI 53786-0001

05

If refund or no tax due ............. PO Box 59, Madison WI 53785-0001

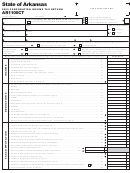

Married Couple Credit When Both Spouses Are Employed

When completing this schedule, be sure to fill in your income in column (A) and your spouse’s income in column (B)

(A) YOURSELF

(B) YOUR SPOUSE

1 Wages, salaries, tips, and other employee compensation

from line 1 of Form 1A. Do not include deferred

compensation or scholarships and fellowships that are

not reported on a W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

.00

2 IRA deduction, if any, from line 9 of Form 1A . . . . . . . . . . . . . 2

.00

.00

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.00

.00

4 Compare amounts in columns (A) and (B) of line 3. Fill in the

.00

smaller amount here. If more than $16,000, fill in $16,000 . . . 4

5 Rate of credit is .03 (3%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.03

X

6 Multiply line 4 by line 5. Round the result and fill in here

Do not fill in

and on line 22 on reverse side . . . . . . . . . . . . . . . . . . . . . . . . . 6

.00

more than $480

*I20005991*

Return to Page 1

1

1 2

2