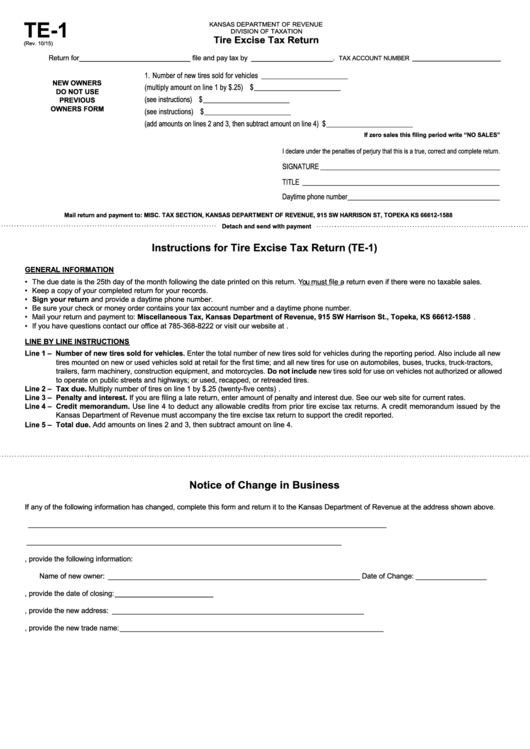

TE-1

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

Tire Excise Tax Return

(Rev. 10/15)

Return for _____________________________ file and pay tax by _____________________ .

TAX ACCOUNT NUMBER __________________________

1. Number of new tires sold for vehicles .................................................................................

_________________________

NEW OWNERS

2. Tax due (multiply amount on line 1 by $.25) ........................................................................ $ _________________________

DO NOT USE

3. Penalty and interest (see instructions) .................................................................................. $ _________________________

PREVIOUS

OWNERS FORM

4. Credit memorandum (see instructions) ............................................................................ $ _________________________

5. Total due (add amounts on lines 2 and 3, then subtract amount on line 4)........................... $ _________________________

If zero sales this filing period write “NO SALES”

I declare under the penalties of perjury that this is a true, correct and complete return.

SIGNATURE ____________________________________________________

TITLE _________________________________________________________

Daytime phone number ____________________________________________

Mail return and payment to: MISC. TAX SECTION, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON ST, TOPEKA KS 66612-1588

Detach and send with payment

Instructions for Tire Excise Tax Return (TE-1)

GENERAL INFORMATION

•

The due date is the 25th day of the month following the date printed on this return. You must file a return even if there were no taxable sales.

•

Keep a copy of your completed return for your records.

•

Sign your return and provide a daytime phone number.

•

Be sure your check or money order contains your tax account number and a daytime phone number.

•

Mail your return and payment to: Miscellaneous Tax, Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66612-1588.

•

If you have questions contact our office at 785-368-8222 or visit our website at .

LINE BY LINE INSTRUCTIONS

Line 1 – Number of new tires sold for vehicles. Enter the total number of new tires sold for vehicles during the reporting period. Also include all new

tires mounted on new or used vehicles sold at retail for the first time; and all new tires for use on automobiles, buses, trucks, truck-tractors,

trailers, farm machinery, construction equipment, and motorcycles. Do not include new tires sold for use on vehicles not authorized or allowed

to operate on public streets and highways; or used, recapped, or retreaded tires.

Line 2 – Tax due. Multiply number of tires on line 1 by $.25 (twenty-five cents).

Line 3 – Penalty and interest. If you are filing a late return, enter amount of penalty and interest due. See our web site for current rates.

Line 4 – Credit memorandum. Use line 4 to deduct any allowable credits from prior tire excise tax returns. A credit memorandum issued by the

Kansas Department of Revenue must accompany the tire excise tax return to support the credit reported.

Line 5 – Total due. Add amounts on lines 2 and 3, then subtract amount on line 4.

Notice of Change in Business

If any of the following information has changed, complete this form and return it to the Kansas Department of Revenue at the address shown above.

1.

Name as shown on tax return ___________________________________________________________________________________________

2.

Tax account number as shown on tax return ________________________________________________________________________________

3.

If the ownership has changed within monthly period, provide the following information:

Name of new owner: ________________________________________________________________

Date of Change: __________________

4.

If the business was discontinued permanently within the period covered by this return, provide the date of closing: _________________________

5.

If the business location was changed, provide the new address: ________________________________________________________________

6.

If the trade name has changed, provide the new trade name: ___________________________________________________________________

1

1