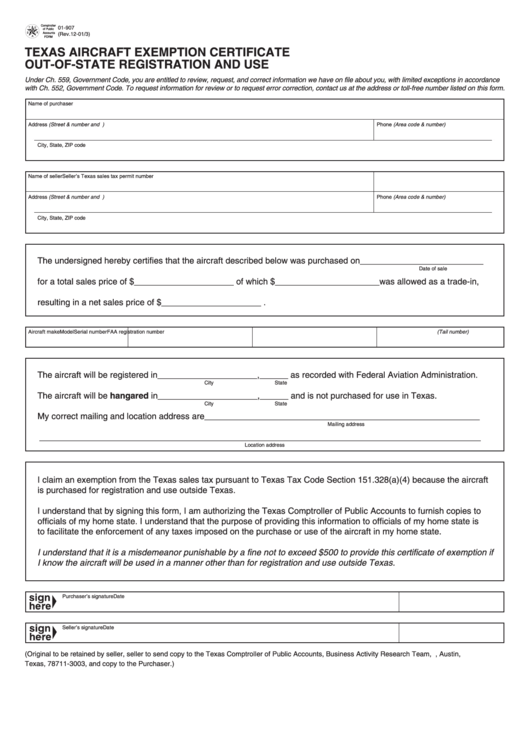

Comptroller

01-907

of Public

Accounts

(Rev.12-01/3)

FORM

TEXAS AIRCRAFT EXEMPTION CERTIFICATE

OUT-OF-STATE REGISTRATION AND USE

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance

with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or toll-free number listed on this form.

Name of purchaser

Address (Street & number and P.O. Box number)

Phone (Area code & number)

City, State, ZIP code

Name of seller

Seller’s Texas sales tax permit number

Address (Street & number and P.O. Box number)

Phone (Area code & number)

City, State, ZIP code

The undersigned hereby certifies that the aircraft described below was purchased on __________________________

Date of sale

for a total sales price of $ _____________________ of which $ ______________________ was allowed as a trade-in,

resulting in a net sales price of $ _____________________ .

Aircraft make

Model

Serial number

FAA registration number (Tail number)

The aircraft will be registered in _____________________ , ______ as recorded with Federal Aviation Administration.

City

State

The aircraft will be hangared in _____________________ , ______ and is not purchased for use in Texas.

City

State

My correct mailing and location address are __________________________________________________________

Mailing address

_____________________________________________________________________________________________

Location address

I claim an exemption from the Texas sales tax pursuant to Texas Tax Code Section 151.328(a)(4) because the aircraft

is purchased for registration and use outside Texas.

I understand that by signing this form, I am authorizing the Texas Comptroller of Public Accounts to furnish copies to

officials of my home state. I understand that the purpose of providing this information to officials of my home state is

to facilitate the enforcement of any taxes imposed on the purchase or use of the aircraft in my home state.

I understand that it is a misdemeanor punishable by a fine not to exceed $500 to provide this certificate of exemption if

I know the aircraft will be used in a manner other than for registration and use outside Texas.

Purchaser’s signature

Date

Seller’s signature

Date

(Original to be retained by seller, seller to send copy to the Texas Comptroller of Public Accounts, Business Activity Research Team, P.O. Box 13003, Austin,

Texas, 78711-3003, and copy to the Purchaser.)

1

1