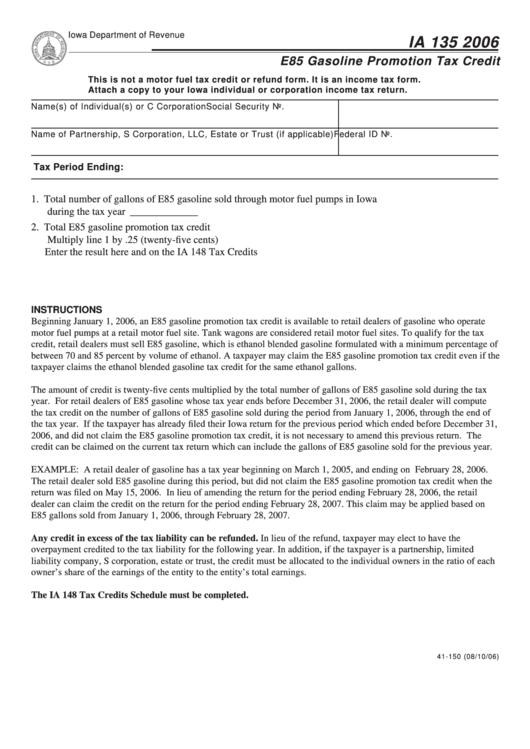

Form Ia 135 - E85 Gasoline Promotion Tax Credit - 2006

ADVERTISEMENT

Iowa Department of Revenue

IA 135 2006

E85 Gasoline Promotion Tax Credit

This is not a motor fuel tax credit or refund form. It is an income tax form.

Attach a copy to your Iowa individual or corporation income tax return.

Name(s) of Individual(s) or C Corporation

Social Security No.

Name of Partnership, S Corporation, LLC, Estate or Trust (if applicable) Federal ID No.

Tax Period Ending:

1. Total number of gallons of E85 gasoline sold through motor fuel pumps in Iowa

during the tax year ...................................................................................................... 1. ________________

2. Total E85 gasoline promotion tax credit

Multiply line 1 by .25 (twenty-five cents)

Enter the result here and on the IA 148 Tax Credits Schedule. .................................. 2. ________________

INSTRUCTIONS

Beginning January 1, 2006, an E85 gasoline promotion tax credit is available to retail dealers of gasoline who operate

motor fuel pumps at a retail motor fuel site. Tank wagons are considered retail motor fuel sites. To qualify for the tax

credit, retail dealers must sell E85 gasoline, which is ethanol blended gasoline formulated with a minimum percentage of

between 70 and 85 percent by volume of ethanol. A taxpayer may claim the E85 gasoline promotion tax credit even if the

taxpayer claims the ethanol blended gasoline tax credit for the same ethanol gallons.

The amount of credit is twenty-five cents multiplied by the total number of gallons of E85 gasoline sold during the tax

year. For retail dealers of E85 gasoline whose tax year ends before December 31, 2006, the retail dealer will compute

the tax credit on the number of gallons of E85 gasoline sold during the period from January 1, 2006, through the end of

the tax year. If the taxpayer has already filed their Iowa return for the previous period which ended before December 31,

2006, and did not claim the E85 gasoline promotion tax credit, it is not necessary to amend this previous return. The

credit can be claimed on the current tax return which can include the gallons of E85 gasoline sold for the previous year.

EXAMPLE: A retail dealer of gasoline has a tax year beginning on March 1, 2005, and ending on February 28, 2006.

The retail dealer sold E85 gasoline during this period, but did not claim the E85 gasoline promotion tax credit when the

return was filed on May 15, 2006. In lieu of amending the return for the period ending February 28, 2006, the retail

dealer can claim the credit on the return for the period ending February 28, 2007. This claim may be applied based on

E85 gallons sold from January 1, 2006, through February 28, 2007.

Any credit in excess of the tax liability can be refunded. In lieu of the refund, taxpayer may elect to have the

overpayment credited to the tax liability for the following year. In addition, if the taxpayer is a partnership, limited

liability company, S corporation, estate or trust, the credit must be allocated to the individual owners in the ratio of each

owner’s share of the earnings of the entity to the entity’s total earnings.

The IA 148 Tax Credits Schedule must be completed.

41-150 (08/10/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1