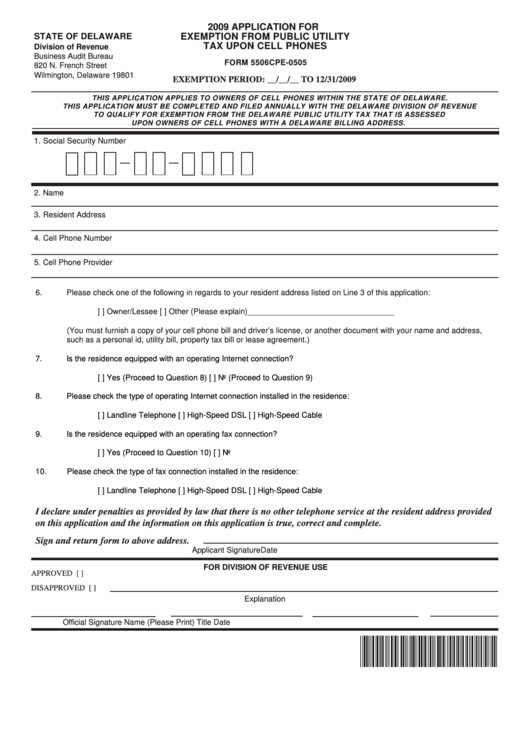

2009 APPLICATION FOR

Reset

STATE OF DELAWARE

EXEMPTION FROM PUBLIC UTILITY

Print Form

TAX UPON CELL PHONES

Division of Revenue

Business Audit Bureau

FORM 5506CPE-0505

820 N. French Street

Wilmington, Delaware 19801

EXEMPTION PERIOD: __/__/__ TO 12/31/2009

THIS APPLICATION APPLIES TO OWNERS OF CELL PHONES WITHIN THE STATE OF DELAWARE.

THIS APPLICATION MUST BE COMPLETED AND FILED ANNUALLY WITH THE DELAWARE DIVISION OF REVENUE

TO QUALIFY FOR EXEMPTION FROM THE DELAWARE PUBLIC UTILITY TAX THAT IS ASSESSED

UPON OWNERS OF CELL PHONES WITH A DELAWARE BILLING ADDRESS.

1.

Social Security Number

2.

Name

3.

Resident Address

4.

Cell Phone Number

5.

Cell Phone Provider

6.

Please check one of the following in regards to your resident address listed on Line 3 of this application:

[ ] Owner/Lessee

[ ] Other (Please explain)_________________________________

(You must furnish a copy of your cell phone bill and driver’s license, or another document with your name and address,

such as a personal id, utility bill, property tax bill or lease agreement.)

7.

Is the residence equipped with an operating Internet connection?

[ ] Yes (Proceed to Question 8)

[ ] No (Proceed to Question 9)

8.

Please check the type of operating Internet connection installed in the residence:

[ ] Landline Telephone

[ ] High-Speed DSL

[ ] High-Speed Cable

9.

Is the residence equipped with an operating fax connection?

[ ] Yes (Proceed to Question 10)

[ ] No

10.

Please check the type of fax connection installed in the residence:

[ ] Landline Telephone

[ ] High-Speed DSL

[ ] High-Speed Cable

I declare under penalties as provided by law that there is no other telephone service at the resident address provided

on this application and the information on this application is true, correct and complete.

Sign and return form to above address.

Applicant Signature

Date

FOR DIVISION OF REVENUE USE

APPROVED [ ]

DISAPPROVED [ ]

Explanation

Official Signature

Name (Please Print)

Title

Date

1

1 2

2