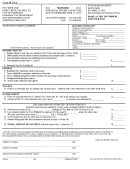

Form Arts 2014 - Arts Income Tax Return Page 2

ADVERTISEMENT

ARTS 2014 Instructions

Provide a Portland address that was the primary residence of the taxfilers in 2014. List a current mailing address if it

is different from the primary residence.

1

2

2014 Federal

If the combined annual income

of all persons in the household

is at or below the

Poverty Guideline

2014 federal poverty guideline (see chart), and you wish to claim a household poverty

exemption, then check “Yes” on line 2. Otherwise, check “No.”

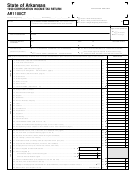

Persons in

Poverty

2

Household

Guideline

List each taxfiler’s full name, Social Security Number, year of birth, and email

1

$11,670

address. Include maiden name if the last name has recently changed.

2

$15,730

If you are claiming a household poverty exemption (you checked “yes” on line 2):

3

$19,790

You must list everyone in your household, including children. Attach an additional

4

$23,850

page if there are more than five members of the household. You must provide each

5

$27,910

1

person’s individual annual income

for the 2014 calendar year. Verification

6

$31,970

documents are required (see line 5).

7

$36,030

If you are not claiming a household poverty exemption (you checked “no” on line

8

$40,090

2): List only adults who were age 18 or older as of December 31, 2014.

For households with more than 8

persons, add $4,060 for each

•

3

Check “Income earner” if the individual had at least $1,000 in taxable income

additional person.

for the 2014 calendar year.

•

3

Check “Annual taxable income less than $1,000” if the individual had $0 to $999.99 in taxable income

for

the 2014 calendar year. Verification documents are required (see line 5).

The total tax amount due equals $35 multiplied by the number of income earners listed on the form.

You must provide verification documents for anyone who did not pay the $35 tax. The requirements depend upon the

taxfiler’s income claim.

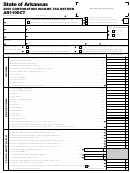

If you checked yes on line 2 (household poverty exemption): Attach a signed copy of your 2014 Federal Form

1040 (page 1 and 2). If you are unable to provide this return (for example, you are not subject to the Form 1040 filing

requirements), you can provide a copy of a public assistance award letter for SNAP (Supplemental Nutrition

Assistance Program) or TANF (Temporary Assistance for Needy Families) benefits. If you cannot provide any of

these you must provide a completed 2014 Federal Form 4506-T (Record of Account) available at

If you checked annual taxable income less than $1,000: Attach Federal Form 1040 and supporting statements

(e.g., W-2s, 1099s, Schedule C, Schedule E, etc.), plus 1099 R(s), Social Security Statement(s), and 1099INT for US

Treasury Interest. If you do not file a Federal tax return, then attach a completed 2014 Federal Form 4506-T (Record

of Account) available at

Complete your filing information and submit this form with payment (if any) to the Revenue Bureau. You may request

that the Revenue Bureau mail you an ARTS 2015 form when it becomes available next year by checking the box.

Mailing address: Revenue Bureau Arts Tax, PO Box 1278, Portland OR 97207-1278

Phone: (503) 865-4278

Fax: (503) 823-5192

TTY: (503) 823-6868

Online: (or )

Physical address: Revenue Bureau, 111 S.W. Columbia Street, Suite 600, Portland, Oregon

1

Annual income for determining the federal poverty exemption follows the definition established by the US Census Bureau and

includes all income earned or received from any source in the 2014 calendar year, regardless of whether it is taxable under state or

federal law. Examples of income include interest from individual or joint savings accounts or other interest bearing accounts, child

support payments, alimony, disability income, unemployment assistance, sales of stocks and other property (even if sold at a loss),

dividends, Social Security income (taxable or non-taxable), gross receipts from a business and wages as an employee.

2

Persons in household includes all residents (adults and children) within a dwelling who file on a single federal or state tax return.

3

Taxable income can be from wages, self-employment, investments (excluding US Treasury interest), rentals, retirement (excluding

Social Security, federal Railroad Retirement Act benefits, Oregon PERS, FERS, and CSRS), disability, unemployment, spousal/child

support, or any other source that the City is not prohibited from taxing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2