Out Of State Worksheet - Palmer Township

ADVERTISEMENT

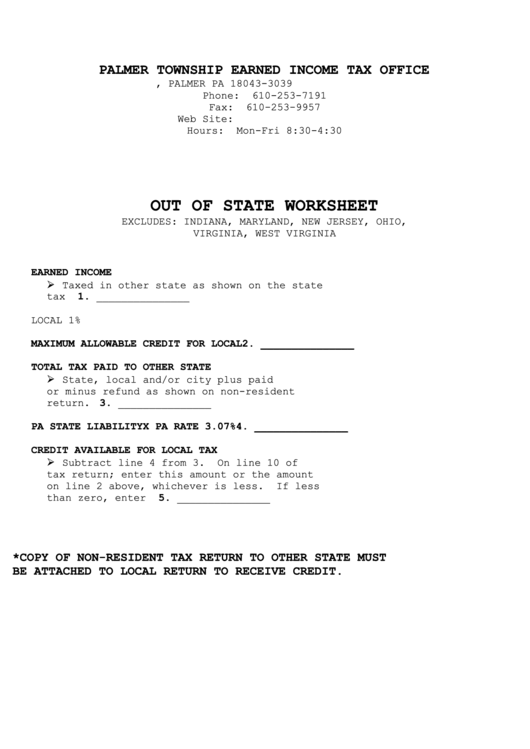

PALMER TOWNSHIP EARNED INCOME TAX OFFICE

P.O. BOX 3039, PALMER PA 18043-3039

Phone:

610-253-7191

Fax:

610-253-9957

Web Site:

Hours:

Mon-Fri 8:30-4:30

OUT OF STATE WORKSHEET

EXCLUDES: INDIANA, MARYLAND, NEW JERSEY, OHIO,

VIRGINIA, WEST VIRGINIA

EARNED INCOME

Taxed in other state as shown on the state

tax return .....................................1. _______________

LOCAL 1% TAX......................................X ________.01____

MAXIMUM ALLOWABLE CREDIT FOR LOCAL................2. _______________

TOTAL TAX PAID TO OTHER STATE

State, local and/or city plus paid

or minus refund as shown on non-resident

return. ........................................3. _______________

PA STATE LIABILITY X PA RATE 3.07%................4. _______________

CREDIT AVAILABLE FOR LOCAL TAX

Subtract line 4 from 3.

On line 10 of

tax return; enter this amount or the amount

on line 2 above, whichever is less.

If less

than zero, enter zero. .........................5. _______________

*COPY OF NON-RESIDENT TAX RETURN TO OTHER STATE MUST

BE ATTACHED TO LOCAL RETURN TO RECEIVE CREDIT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1