Form Pet 357 - Governmental Sales Claim For Refund - Tennessee Department Of Revenue - 2016

ADVERTISEMENT

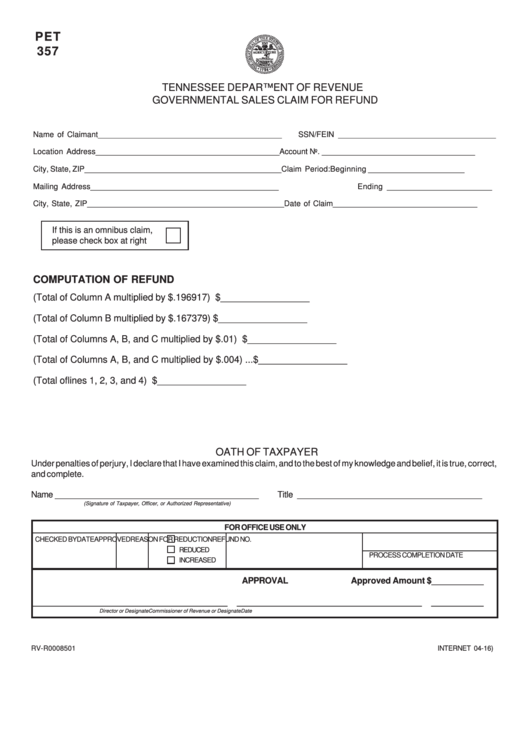

PET

357

TENNESSEE DEPARTMENT OF REVENUE

GOVERNMENTAL SALES CLAIM FOR REFUND

Name of Claimant __________________________________________

SSN/FEIN ____________________________________

Location Address __________________________________________

Account No. ___________________________________

City, State, ZIP _____________________________________________

Claim Period:

Beginning ______________________

Mailing Address ___________________________________________

Ending ________________________

City, State, ZIP _____________________________________________

Date of Claim _________________________________

If this is an omnibus claim,

please check box at right

COMPUTATION OF REFUND

1. Gasoline Tax (Total of Column A multiplied by $.196917) ........................................... $ _________________

2. Diesel Tax (Total of Column B multiplied by $.167379) ............................................... $ _________________

3. Special Tax (Total of Columns A, B, and C multiplied by $.01) ................................... $ _________________

4. Environmental Assurance Fee (Total of Columns A, B, and C multiplied by $.004) ... $ _________________

5. Total Refund Due (Total of lines 1, 2, 3, and 4) ........................................................... $ _________________

OATH OF TAXPAYER

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct,

and complete.

Name ___________________________________________

Title _______________________________________

(Signature of Taxpayer, Officer, or Authorized Representative)

FOR OFFICE USE ONLY

CHECKED BY

DATE

APPROVED

REASON FOR REDUCTION

REFUND NO.

REDUCED

PROCESS COMPLETION DATE

INCREASED

APPROVAL

Approved Amount $ ___________

_________________________________________

_______________________________________

___________

Director or Designate

Commissioner of Revenue or Designate

Date

RV-R0008501

INTERNET 04-16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2