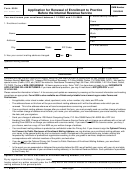

Form 8554 - Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service - 1998 Page 3

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING FORM 8554

1. Review carefully the information printed in Section A and make corrections in the

space provided.

2. Check the appropriate line in Section B to indicate your eligibility status.

3. Complete the Report of Continuing Professional Education in Section C.

Remember you are reporting only continuing professional education hours earned

between 2/1/96 and 1/31/99; or if enrolled during the cycle, 2 hours for each month

you were enrolled between 2/1/96 and 1/31/99.

4. Answer the questions in Section D.

5. Sign and date the form in Section E.

6. Attach a check or money order for $80 payable to Internal Revenue Service.

*Mail to: U.S. Treasury/IRS Enrollment, P.O. Box 845854, Dallas TX 75284-5854.

*NOTE: If you do not renew your enrollment, you will be placed in inactive status.

Section 10.6(k)(6) of Treasury Department Circular No. 230 provides: An individual

placed in an inactive status must file an application for renewal of enrollment and

satisfy the requirements for renewal as set forth in this section within three years of

being placed in an inactive status. Otherwise, the name of such individual will be

removed from the inactive enrollment roster and his/her enrollment will be terminated.

*** THE RENEWAL FEE IS $80.***

Form 8554 (Rev. 6-98)

Department of the Treasury — Internal Revenue Service

Cat. No. 21842Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3