Form 8554 - Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service - 1998

ADVERTISEMENT

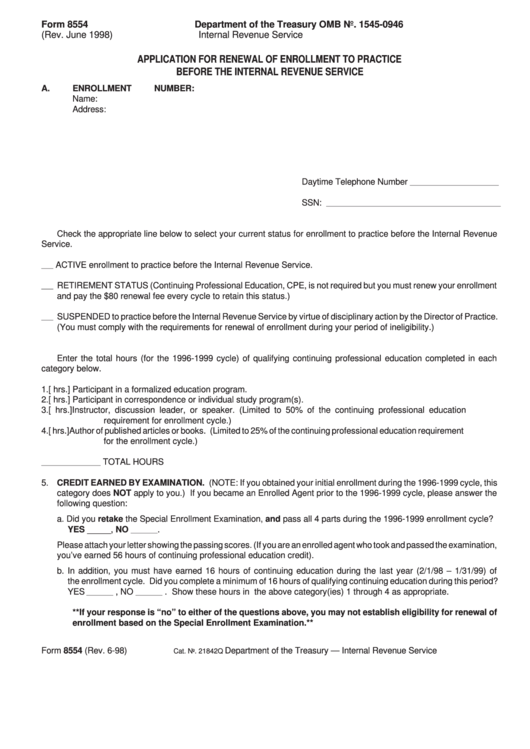

Form 8554

Department of the Treasury

OMB No. 1545-0946

(Rev. June 1998)

Internal Revenue Service

APPLICATION FOR RENEWAL OF ENROLLMENT TO PRACTICE

BEFORE THE INTERNAL REVENUE SERVICE

A.

ENROLLMENT NUMBER:

Name:

Address:

Daytime Telephone Number

______________________________

SSN:

___________________________________________________________

B. ELIGIBILITY STATUS

Check the appropriate line below to select your current status for enrollment to practice before the Internal Revenue

Service.

ACTIVE enrollment to practice before the Internal Revenue Service.

____

RETIREMENT STATUS (Continuing Professional Education, CPE, is not required but you must renew your enrollment

____

and pay the $80 renewal fee every cycle to retain this status.)

SUSPENDED to practice before the Internal Revenue Service by virtue of disciplinary action by the Director of Practice.

____

(You must comply with the requirements for renewal of enrollment during your period of ineligibility.)

C. REPORT OF CONTINUING PROFESSIONAL EDUCATION

Enter the total hours (for the 1996-1999 cycle) of qualifying continuing professional education completed in each

category below.

1. [

hrs.] Participant in a formalized education program.

2. [

hrs.] Participant in correspondence or individual study program(s).

3. [

hrs.] Instructor, discussion leader, or speaker. (Limited to 50% of the continuing professional education

requirement for enrollment cycle.)

4. [

hrs.] Author of published articles or books. (Limited to 25% of the continuing professional education requirement

for the enrollment cycle.)

TOTAL HOURS

____________________

5. CREDIT EARNED BY EXAMINATION. (NOTE: If you obtained your initial enrollment during the 1996-1999 cycle, this

category does NOT apply to you.) If you became an Enrolled Agent prior to the 1996-1999 cycle, please answer the

following question:

a. Did you retake the Special Enrollment Examination, and pass all 4 parts during the 1996-1999 enrollment cycle?

YES _____, NO

.

_________

Please attach your letter showing the passing scores. (If you are an enrolled agent who took and passed the examination,

you’ve earned 56 hours of continuing professional education credit).

b. In addition, you must have earned 16 hours of continuing education during the last year (2/1/98 – 1/31/99) of

the enrollment cycle. Did you complete a minimum of 16 hours of qualifying continuing education during this period?

YES

, NO

. Show these hours in the above category(ies) 1 through 4 as appropriate.

_________

_________

**If your response is “no” to either of the questions above, you may not establish eligibility for renewal of

enrollment based on the Special Enrollment Examination.**

Form 8554 (Rev. 6-98)

Department of the Treasury — Internal Revenue Service

Cat. No. 21842Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3