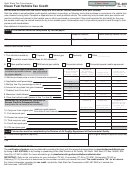

Arizona Form 313 - 2000 Alternative Fuel Vehicle (Afv) Credit Page 5

ADVERTISEMENT

F

o

r

m

3

1

3

F

o

r

m

3

1

3

LEV

low emission vehicle

Actual Purchase Price, Cost and MBRP continued

new

Actual Purchase

If you leased a

vehicle, the actual purchase

ULEV

ultra low emission vehicle

Price For the

price of the vehicle is the capitalized cost minus

Lease of a New

the sum of any customer rebates, factory-to-

ILEV

inherently low emission vehicle

AFV

dealer incentives, document preparation fees,

ZEV

zero emission vehicle

registration fees, title fees and the residual value

of the vehicle as shown on the lease. For

SULEV

super ultra low emission vehicle

vehicles over 12,000 pounds gross vehicle

If you are unsure of the emission level of your AFV, check with your

weight, this does not include the cost of any

local dealer or manufacturer for the emission certification level of

attachment not associated with the operation of

your specific model.

the vehicle.

Cost For the

The cost of the vehicle is the amount you paid

Incremental Cost

Purchase or

for the vehicle minus the sum of any customer

Use the chart below to determine how to figure the incremental cost.

Conversion of a

rebates, factory-to-dealer incentives, document

Type of Vehicle

How to Figure the Incremental Cost

Used AFV

preparation fees, registration fees, title fees,

Factory

The incremental cost is the amount by which the

amounts paid for extended warranties, or

Manufactured

cost of the AFV exceeds the cost of the same

aftermarket equipment installed on the vehicle.

LEV,

ULEV,

model of conventionally fueled vehicle that is

For vehicles over 12,000 pounds gross vehicle

ILEV, SULEV

similarly equipped.

This is the cost of the

weight, this does not include the cost of any

alternative fuel option.

attachment not associated with the operation of

Factory

For a zero emission vehicle the incremental cost is

the vehicle.

Manufactured

assumed to be $10,000 or 25% of the cost,

Cost For the

If you leased a used vehicle, the cost of the

ZEV

whichever is more.

Lease of a Used

vehicle is the capitalized cost minus the sum of

Conversion

In the case of a conversion, the incremental cost is

AFV

any

customer

rebates,

factory-to-dealer

the cost of conversion.

incentives,

document

preparation

fees,

Leased AFV

ZERO. A leased AFV is not eligible for a credit

registration fees, title fees and the residual value

for the incremental cost.

of the vehicle as shown on the lease. For

vehicles over 12,000 pounds gross vehicle

Actual Purchase Price, Cost and MBRP

weight, this does not include the cost of any

Use the chart below to determine the actual purchase price, cost, and the

attachment not associated with the operation of

manufacturer’s base retail price (MBRP).

the vehicle.

Actual Purchase

The actual purchase price of the vehicle is the

Manufacturer’s

MBRP is the total price on the manufacturer’s

Price For the

amount you paid for the vehicle, including

Base Retail Price

invoice minus any destination charges. MBRP

Purchase or

dealer options and a reasonable dealer prep fee,

(MBRP)

does not include any dealer add-ons or other

Conversion of a

minus the sum of any customer rebates,

added charges. In most cases, MBRP will be

New AFV

factory-to-dealer

incentives,

document

the list price shown on the Arizona title and

preparation fees, registration fees, title fees,

registration. In the case of a vehicle with a

fleet car discounts, amounts paid for extended

gross vehicle weight of over 12,000 pounds,

warranties, or aftermarket equipment installed

MBRP does not include the cost of any

on the vehicle. For vehicles over 12,000 pounds

attachment not associated with the operation of

gross vehicle weight, this does not include the

the vehicle.

cost of any attachment not associated with the

operation of the vehicle.

Gross Vehicle Weight

Use the following information to figure the gross vehicle weight of your

vehicle.

The gross vehicle weight is the amount shown on the affidavit you

received from the Department of Commerce/Office of Alternative Fuel

Recovery, unless that amount was based on misrepresentation by the

claimant.

New or Used Vehicle

Use the following information to determine whether your vehicle is a

new or a used vehicle.

New

A new vehicle is a vehicle that was never registered and

Vehicle

titled anywhere before its conversion to operate on

alternative fuel. However, a new vehicle includes a vehicle

that is converted after the vehicle is registered and titled, if

the taxpayer ordered the conversion of the vehicle when the

taxpayer purchased the vehicle.

Used

A used vehicle is any vehicle other than a new vehicle

Vehicle

5

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7