Form 454-A - Affidavit Of Surviving Spouse

ADVERTISEMENT

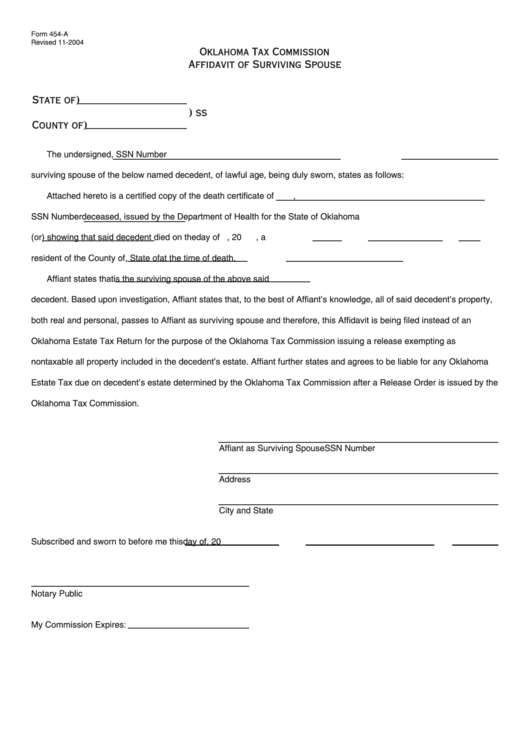

Form 454-A

Revised 11-2004

Oklahoma Tax Commission

Affidavit of Surviving Spouse

State of

)

)

ss

County of

)

The undersigned

, SSN Number

surviving spouse of the below named decedent, of lawful age, being duly sworn, states as follows:

Attached hereto is a certified copy of the death certificate of

,

SSN Number

deceased, issued by the Department of Health for the State of Oklahoma

(or

) showing that said decedent died on the

day of

, 20

, a

resident of the County of

, State of

at the time of death.

Affiant states that

is the surviving spouse of the above said

decedent. Based upon investigation, Affiant states that, to the best of Affiant’s knowledge, all of said decedent’s property,

both real and personal, passes to Affiant as surviving spouse and therefore, this Affidavit is being filed instead of an

Oklahoma Estate Tax Return for the purpose of the Oklahoma Tax Commission issuing a release exempting as

nontaxable all property included in the decedent’s estate. Affiant further states and agrees to be liable for any Oklahoma

Estate Tax due on decedent’s estate determined by the Oklahoma Tax Commission after a Release Order is issued by the

Oklahoma Tax Commission.

Affiant as Surviving Spouse

SSN Number

Address

City and State

Subscribed and sworn to before me this

day of

, 20

Notary Public

My Commission Expires:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1