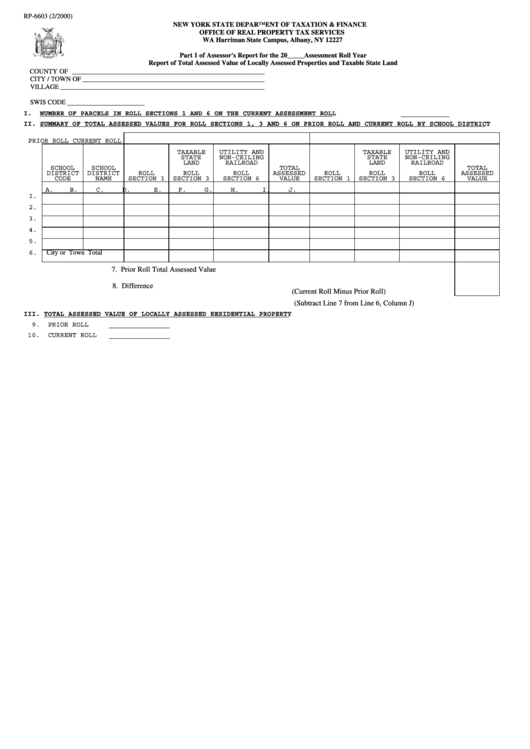

Form Rp-6603 - Report Of Total Assessed Value Of Locally Assessed Properties And Taxable State Land

ADVERTISEMENT

RP-6603 (2/2000)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

WA Harriman State Campus, Albany, NY 12227

Part 1 of Assessor's Report for the 20_____Assessment Roll Year

Report of Total Assessed Value of Locally Assessed Properties and Taxable State Land

COUNTY OF

CITY / TOWN OF

VILLAGE

SWIS CODE

I.

NUMBER OF PARCELS IN ROLL SECTIONS 1 AND 6 ON THE CURRENT ASSESSMENT ROLL

____________

II. SUMMARY OF TOTAL ASSESSED VALUES FOR ROLL SECTIONS 1, 3 AND 6 ON PRIOR ROLL AND CURRENT ROLL BY SCHOOL DISTRICT

PRIOR ROLL

CURRENT ROLL

TAXABLE

UTILITY AND

TAXABLE

UTILITY AND

NON-CEILING

STATE

NON-CEILING

STATE

LAND

RAILROAD

LAND

RAILROAD

SCHOOL

SCHOOL

TOTAL

TOTAL

DISTRICT

DISTRICT

ROLL

ROLL

ROLL

ASSESSED

ROLL

ROLL

ROLL

ASSESSED

CODE

NAME

SECTION 1

SECTION 3

SECTION 6

VALUE

SECTION 1

SECTION 3

SECTION 6

VALUE

A.

B.

C.

D.

E.

F.

G.

H.

I.

J.

1.

2.

3.

4.

5.

City or Town Total

6.

7. Prior Roll Total Assessed Value

8. Difference

(Current Roll Minus Prior Roll)

(Subtract Line 7 from Line 6, Column J)

III. TOTAL ASSESSED VALUE OF LOCALLY ASSESSED RESIDENTIAL PROPERTY

9.

PRIOR ROLL

_______________

10.

CURRENT ROLL

_______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4