Form Rp-458-A - Instructions For Application For Alternative Veterans Exemption From Real Property Taxation

ADVERTISEMENT

New York State Board of Real Property Services

RP-458-a-Ins (1/00)

INSTRUCTIONS FOR APPLICATION FOR ALTERNATIVE

VETERANS EXEMPTION FROM REAL PROPERTY TAXATION

Section 458-a of the Real Property Tax Law provides a limited exemption from real property taxes for

real property owned by persons who rendered military service to the United States, provided such property meets

the requirements set forth in the law. The task of administering this law lies primarily with local assessors who

are required to pass upon each application for exemption.

These instructions are intended to assist applicants in the completion of form RP-458-a and to discuss

issues concerning the alternative veterans exemption. Technical discussion has been avoided so that the material

will have the widest possible usefulness. Assessors may address their questions to the Counsel of the State

Board of Real Property Services, Sheridan Hollow Plaza, 16 Sheridan Ave., Albany, N.Y. 12210-2714.

Veterans should address their inquires to their local office of the New York State Division of Veterans' Affairs or

their County Veterans' Service Agency.

Section 458-a of the Real Property Tax Law of the State of New York provides an alternative exemption

from real property taxation for qualified residential real property owned by veterans of defined periods of war,

veterans who received expeditionary medals, or certain of their family members, based on a percentage of

assessed value. The alternative exemption is applicable to general municipal taxes, but not school taxes, special

ad valorem levies or special assessments.

Each county, city, town and village was given the option of deciding whether to grant the alternative

exemption. If the decision was made initially not to grant the alternative veterans exemption, the local legislative

body may change that decision. You should check with your assessor to determine whether the exemption is

available for your property.

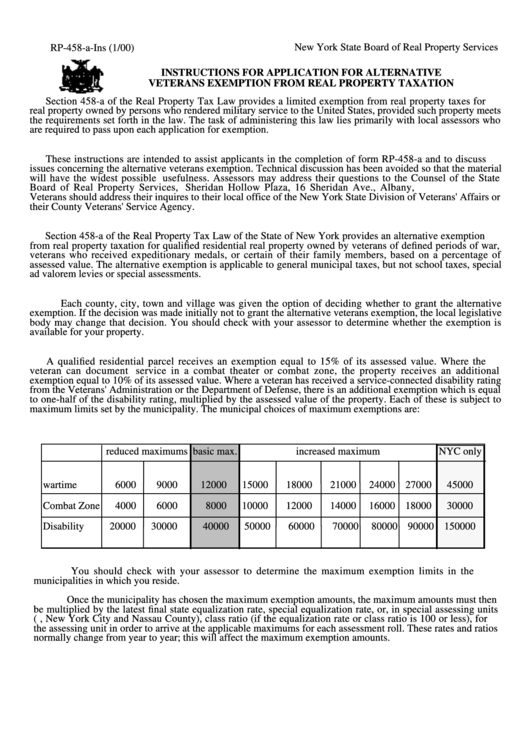

A qualified residential parcel receives an exemption equal to 15% of its assessed value. Where the

veteran can document service in a combat theater or combat zone, the property receives an additional

exemption equal to 10% of its assessed value. Where a veteran has received a service-connected disability rating

from the Veterans' Administration or the Department of Defense, there is an additional exemption which is equal

to one-half of the disability rating, multiplied by the assessed value of the property. Each of these is subject to

maximum limits set by the municipality. The municipal choices of maximum exemptions are:

reduced maximums basic max.

increased maximum

NYC only

wartime

6000

9000

12000

15000

18000

21000

24000 27000

45000

Combat Zone

4000

6000

8000

10000

12000

14000

16000 18000

30000

Disability

20000

30000

40000

50000

60000

70000

80000 90000 150000

You should check with your assessor to determine the maximum exemption limits in the

municipalities in which you reside.

Once the municipality has chosen the maximum exemption amounts, the maximum amounts must then

be multiplied by the latest final state equalization rate, special equalization rate, or, in special assessing units

(i.e., New York City and Nassau County), class ratio (if the equalization rate or class ratio is 100 or less), for

the assessing unit in order to arrive at the applicable maximums for each assessment roll. These rates and ratios

normally change from year to year; this will affect the maximum exemption amounts.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3