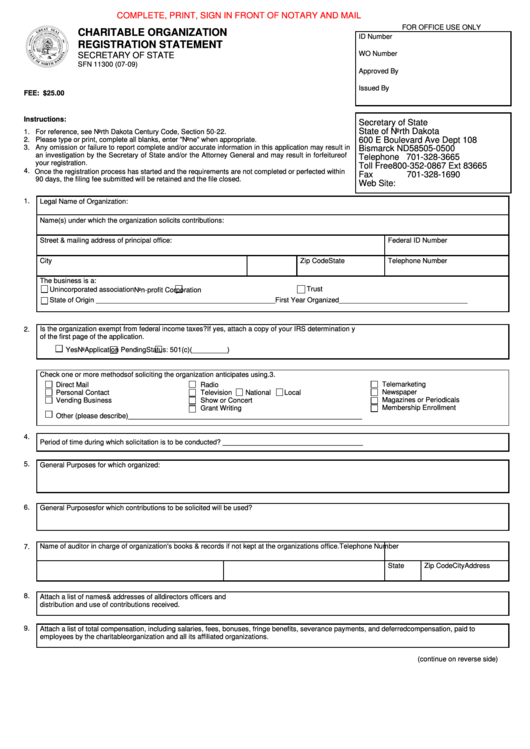

COMPLETE, PRINT, SIGN IN FRONT OF NOTARY AND MAIL

FOR OFFICE USE ONLY

CHARITABLE ORGANIZATION

ID Number

REGISTRATION STATEMENT

WO Number

SECRETARY OF STATE

SFN 11300 (07-09)

Approved By

Issued By

FEE: $25.00

Instructions:

Secretary of State

State of North Dakota

1.

For reference, see North Dakota Century Code, Section 50-22.

2.

Please type or print, complete all blanks, enter "None" when appropriate.

600 E Boulevard Ave Dept 108

3.

Any omission or failure to report complete and/or accurate information in this application may result in

Bismarck ND 58505-0500

an investigation by the Secretary of State and/or the Attorney General and may result in forfeiture of

Telephone 701-328-3665

your registration.

Toll Free

800-352-0867 Ext 83665

4. Once the registration process has started and the requirements are not completed or perfected within

Fax

701-328-1690

90 days, the filing fee submitted will be retained and the file closed.

Web Site:

1.

Legal Name of Organization:

Name(s) under which the organization solicits contributions:

Street & mailing address of principal office:

Federal ID Number

City

State

Zip Code

Telephone Number

The business is a:

Trust

Unincorporated association

Non-profit Corporation

State of Origin ______________________________________________

First Year Organized_________________________________

2.

Is the organization exempt from federal income taxes? If yes, attach a copy of your IRS determination letter. If the application is pending attach a copy

of the first page of the application.

Yes

No

Application Pending

Status: 501(c)(_________)

3.

Check one or more methods of soliciting the organization anticipates using.

Direct Mail

Radio

Telemarketing

Newspaper

Personal Contact

Television

National

Local

Vending Business

Magazines or Periodicals

Show or Concert

Membership Enrollment

Grant Writing

Other (please describe)____________________________________________________________

4.

Period of time during which solicitation is to be conducted? ____________________________________

5.

General Purposes for which organized:

6.

General Purposes for which contributions to be solicited will be used?

Name of auditor in charge of organization's books & records if not kept at the organizations office.

Telephone Number

7.

Address

City

State

Zip Code

8.

Attach a list of names & addresses of all directors officers and trustees. Indicate the individuals having the final discretion or authority as to the

distribution and use of contributions received.

9.

Attach a list of total compensation, including salaries, fees, bonuses, fringe benefits, severance payments, and deferred compensation, paid to

employees by the charitable organization and all its affiliated organizations.

(continue on reverse side)

1

1 2

2